|

One year ago, industrial land was selling to developers like hotcakes. Today those developers are struggling to make development pencil out. While lease rates have increased and vacancies are at an all-time low, the cost of building has also increased. Some developers have paused speculative projects. This stagnant supply and strong demand dynamic are creating challenges for tenants, brokers, and developers. Transaction volumes are considerably less than what they were one year ago as tenants and buyers can’t find available space and interest rates have grid-locked the investment side of the market.

A separate but related concern throughout the market is the increase in NNN expenses. Insurance rates are increasing across the board, taxes are increasing, and maintenance costs are increasing. Persistent labor challenges are also driving the costs of.............. Click below to read the full Trend Report trendreportaz.com/wp-content/uploads/2023/04/TRENDreportMay2023.pdf

0 Comments

3740 E 43rd Pl sold for $1,090,000 Max Fisher, BRD Realty handled this transaction Washington Inaugural Properties LLC purchased the 10,000 SF warehouse from RICMICNIK LLC Pascua Yaqui Tribe purchased a 3,680 SF trucking terminal on 2.95 acres from CDR Leasing LLC for $750,000 Max Fisher, BRD Realty represented the seller. Veronica Robles, Homesmart Advantage Group represented the buyer 1615 W Grant, a 7,200 SF warehouse was leased to Better Box LLC. Max Fisher, BRD Realty handled this transaction. The landlord was Rodgers-Hoge Partners.

2,130 SF of warehouse at 8101 E Research Court was leased by Tony's Tuning and Specialties LLC. Max Fisher, BRD Realty handled this transaction. Research Investors LLC was the landlord. 1,000 SF of warehouse at 2112 N Dragoon Suite 19 was leased to Seven Eleven Customs. Max Fisher, BRD Realty handled this transaction. the landlord was Rich Rodgers South Inc. 1,700 SF of warehouse at 50 W Fort Lowell was leased to Zachary Jones. Max Fisher, BRD Realty handled this transaction. the landlord was R Legacy Irrevocable Trust. The fed is aggressively hiking rates, residential rents are starting to drop, and residential sales are slowing. Sellers are losing leverage slowly. Pulte just cancelled $800,000,000 in land acquisitions and lost $24,000,000 in earnest money deposits, but it’s still difficult to find a rental or a decent home that isn’t a new build.

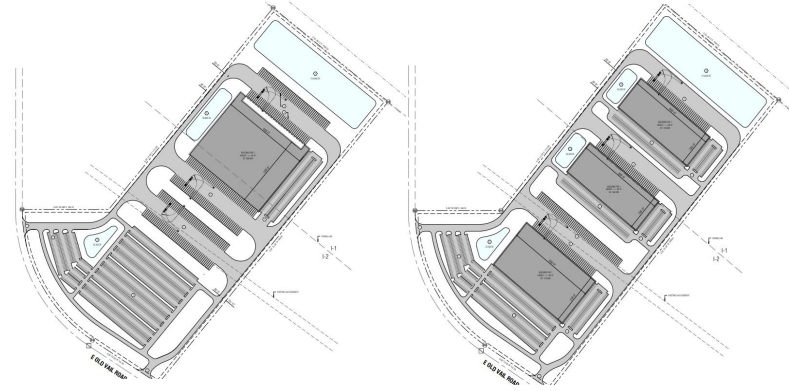

Industrial vacancy is at an all time low, construction is at an all time high. If you’re an industrial tenant or buyer, good luck finding a building or land. Price per square foot for industrial has come close to doubling just within 2 years. Industrial rents are still increasing but at a slower pace compared to 2021. Available entitled industrial land is sparce. Ag land in Marana is being re-zoned to industrial. Amazon has put most of real estate expansions on hold while the brand new 200,000SF+ warehouse at Ina and Silverbell is still TBD. The stock market is starting to ripple into the real estate market with Meta announcing 11,000 layoffs and a pull out of the largest office lease in Austin. Construction costs are continuing to increase despite raw materials dropping. We can most likely attribute increased costs to the increase in trade wages and fuel/energy. Wage inflation typically lags. Supply chain disruptions seem to be evening out overall. Jerome Powell’s last speech didn’t indicate any slowing of rate hikes in the near future. Rate hikes are freezing capital markets and we can expect cap rates to adjust upwards. October’s inflation rate was announced this morning at 7.7%. This is great news as inflation dropped .5% month over month. Maybe Powell will pivot in 2023. This good news has the Nasdaq up 5.79% so far today. Office seems to be slow and lame, especially Class B, C and non-medical space. In June, a client sold a 7 unit office complex for $70 per square foot and traded into an industrial/flex park for $80 foot. The same client converted an old shopping center into small bay warehouses and now there’s only one vacancy at this former shopping center. The tenants that leased the warehouse conversions are gyms, contractors, Ecommerce businesses, and an after market auto related business. Retail is a mixed bag with big box looking lame while PADs, drive throughs and food related property is going strong. 9 months ago developers would get 10 separate term sheets from lenders, today they’re getting 3 and the terms are much different. With rougher debt terms, debt is becoming tougher to justify without cap rates moving much. I get at least one call per month asking for any distressed asset opportunities. They don’t exist right now. One global economic factor that gets little attention, should be getting 100x as much attention. The energy crisis in Europe. With Nordstream flows shut, Europe is having to import natural gas via ports from the US and the Middle East, instead of pipelines, which is incredibly costly. Inflation is significantly higher in Europe and isn’t showing signs of slowing. If the US has to import more and more gas and oil to Europe, this will affect US energy costs. Most people don’t know that TEP is mostly run on natural gas, along with many other utility providers. US Natural Gas prices are up 280% since August 2019. Could the global energy markets be dependent on a cold or warm European winter? How will the energy markets affect inflation? How will inflation affect the Fed? Do you know what the next year holds? Who the hell knows. I wish you all, happy holidays and a prosperous Q4 and 2023 : ) -Max Fisher, BRD Realty [email protected] *In the former article, Dr Horton was mentioned. That was a mistake, Pulte's earnings call referenced the $800,000,000 in cancelled land acquisitions.* • Neighboring companies: Raytheon, Target.com, Amazon, Hudbay, University of Arizona Tech Parks, TuSimple, IBM, La Costena Manufacturing, Port of Tucson, AirLiquide, and United Healthcare • Preliminary site plans and renderings in hand • Less than .5 mile from I-10 • Survey and Phase One Environmental in hand • City of Tucson Industrial zoning • Zoned for cannabis cultivation • Flat terrain • Electric, gas, water, and sewer at the lot line • Frontage on Old Vail Road Vail is a quickly growing industrial and tech market with quick access to I-10, I-19 and the new announcement of the Sonoran Corridor which connects I-19 to Rita Road at I-10, the same exit for Sunbelt Industrial. TuSimple recently built proving grounds and an engineering campus less than a half mile from Sunbelt Industrial and the Target.com Distribution Center is less than a half mile as well. Sunbelt Industrial is surrounded by UA Tech Parks, IBM, Raytheon, Target Distribution, TuSimple, Amazon, the Port of Tucson, Becton Dickson, Hudbay, Tetakwai, and two new cannabis cultivators. Electric, water, sewer, gas and telecommunications are at the lot line, a survey and phase 1 are in hand, and the parcel is already zoned I-1 and I-2 which makes this parcel shovel ready for distributors, manufacturers and cannabis cultivators. This is a prime shovel ready site for mid-large scale industrial users in the Southwest region. Contact Max Fisher for more information. [email protected] 520-465-9989 Click below to download the brochure

2102 N Forbes, a three tenant, flex-industrial business park sold for $1,000,000. Tenants include StageTucson, Meter-Toledo, and Everest Infrared. The property consists of 11,900 SF, 3 phase power, 4 grade level roll up doors, concrete-tilt construction, and 14 foot ceilings.

The Grant and I-10 sub-market is the strongest industrial sub-market in Tucson and torch expects this property to maintain a consistent level of low vacancy. Despite interest rate hikes, two quarters of negative GDP and a cooling housing market, the industrial market remains strong. We can attribute the strength of the industrial market to the growing retail-e-commerce market, new construction market, overseas supply chain relocation and a lack of inventory.

With a handful of 40+ acre industrial parcels recently sold or in escrow, we can expect new to Tucson developers to start breaking ground in the second half of 2022. The vast majority of this new speculative construction will be catered to distributors and manufacturers occupying 20,000 SF + bays. There has been some talk of interest rates affecting new developments and banks starting to underwrite these developments more conservatively. Recently, we have seen an increase in seller carry back financing and expect to see this trend grow. User demand for large industrial parcels of land continues as China faces more shutdowns which is driving companies to relocate their manufacturing to the US and Mexico. We don’t expect this trend to slow down any time soon as supply chain challenges look more long term than short term. So far, there has been no new construction of bays less than 5,000 SF which is putting pressure on small bay industrial business parks. In addition, upcoming redevelopment projects of industrial property are also a key factor in the limited existing supply. Currently, the vacancy rate is below 5% as out of state investors are purchasing property at record low cap rates. To justify the low returns, out of state investors are raising lease rates at least 20%. There have even been reports of 80% increases from out of state investors in lease rates for incubator industrial buildings. Building materials seem to be flattening while commodities such as steel, copper and lumber start to drop in price. Inflationary pressures continue to affect small and large businesses, especially in the transportation sector as fuel and energy remains high. The two largest problems that businesses are facing today is a lack of labor and inflationary pressures. Arizona is one of the best positioned states right now as migration continues, supply chain is moving from overseas to Arizona after covid shutdowns disrupted the supply chain, and copper demand continues to increase as the EV, electronics and solar market grows rapidly. Here are a few of our recent deals highlighted:

Eileen Lewis was interviewed in regards to the current state of the industrial market in Tucson Arizona. James Breeze, senior director and global head of Industrial and Logistics Research at CBRE; Eileen Lewis, director of Property Management at Torch Properties; and Samantha Turner, senior real estate manager at Weyerhaeuser Company were also on the panel.

Some of the key takeaways include: -There is no doubt that Covid has propelled the industrial market. -Despite increased construction, vacancy remains low. -Materials and labor remain high. -The Amazon effect is spurring other retailers to lease distribution space. -Tucson is seeing small-medium bay tenants move to Tucson because they can't find space in Phoenix and Tucson still more affordable that Phoenix. -Vacancy remains very low in the Tucson market. Below is the link to the BOMA panel interview A Deeper Dive with BOMA: Taking Stock of Market Vitality in the Industrial Sector (June 2022) - BOMA TV 37,528sf, $1,800,000 Multi-tenant industrial building located in the Eastside Research Loop industrial park. Purchase price $1,800,000. Torch Properties, LLC, through an affiliate entity, purchased 8075-8101 E Research Court from Con-Cor International. The sale closed on 5/4/2022.

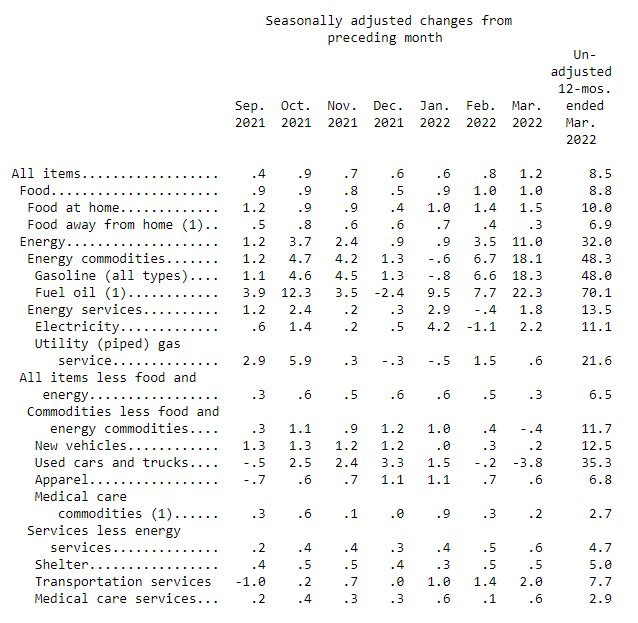

Contact Max Fisher, BRD Realty for leasing opportunities 520-465-9989 Today the March inflation rate was announced at 8.5%. This comes on the heals of a 2% interest rate hike within the past few months. The market has yet to react negatively to the rise in interest rates. We can associate the lack of interest rate reaction to sustained home building, the increase in E-commerce and steady migration from California and other densely populated cities and states.

CPI per the Bureau of Labor Statistics Energy Commodities: 48% Utility Gas Service: 21.6% Used Cars & Trucks: 35.3% Food: 8.8% Shelter: 5% The industrial market has seen user building and land sales increase by 40-70% since January 2021. Industrial lease rates have also climbed significantly as recent institutional investors have entered the Tucson market, purchasing industrial property and business parks from local investors. Out of state investors are purchasing property at record low cap rates. To justify the low returns, out of state investors are raising lease rates at least 20%. There have even been reports of 80% increases from out of state investors in lease rates for incubator buildings. Upcoming redevelopment projects of industrial property are also a key factor in the existing supply. There are many factors that aren’t showing signs of price leveling, especially the energy and housing sector. The increase in interest rates may make development of rental units more challenging for the developer/investor which can taper new builds. Recent land acquisitions are foreshadowing increased development both in the housing market and industrial market as inventory remains very low. The labor shortages and price increases for materials and commodities doesn't help new supply as key commodities remain high. Copper remains close to $5, lumber is up more than 300% over the past 5 years, natural gas has more than doubled in the past year, and gasoline is up 66% in the past year. Cost of materials and labor shortages have put pressure on businesses, especially small businesses. This has created a trend of business owners shutting their businesses down or selling their businesses to larger corporations as larger corporations can pass the increases onto the consumer easier and absorb challenges better than small businesses can. The war in Ukraine combined with OPEC denying production increases , and the lack of US energy production signals a very challenging future for energy prices and a tough road ahead for those businesses that consume larger amount of gasoline, diesel, natural gas and electricity. The natural gas prices are also affecting the local economy as most of our electricity is dependent on natural gas, not coal. We can expect significant electricity rate increases on a local level due to natural gas price increases and potential shortages. So what’s next? I don’t know but I tend to be an optimist. In my opinion, Arizona is one of the best positioned states right now as migration continues, supply chain is moving from overseas to Arizona after covid shutdowns disrupted the supply chain, copper demand continues to increase as the EV, electronics and solar market grows rapidly. Global stagflation could be next on the horizon but Arizona may offset those affects with the factors listed above. The president's recent expressed interest in an executive order which would cut red tape and increase production for EV materials mining such as copper, cobalt, lithium, nickel, and graphite could significantly boost the Arizona economy. Employees are not going back to the office like economists predicted. This lack of office demand has forced landlords to lower rates or let their buildings sit vacant.

In an effort to lease our vacant offices, we have reduced lease rates substantially to compete with other office landlords. We have noticed over the past year and a half, the office vacancy has increased drastically and now office tenants' priority is more price related rather than location or amenity related. The labor shortage has provided employees with more leverage than ever. Employees can choose where they want to work as employers face labor shortages. The work from home model does not seem to be going way any time soon. Lately, the office leases that we have completed are leasing for less PSF compared to the warehousing rates. It seems that the office demand that does exist is either medical or from companies migrating to the region from other states. In addition to lowering office lease rates, there are rumors of developers purchasing office buildings and converting them to multi-family housing. Phoenix is now in the works to re-zone shopping centers for multi-family as the housing shortage continues while migration from California continues to grow day by day. Meanwhile, industrial rates continue to rise quickly as the vacancy rate is below 5% and demand is not slowing. Inflation continues to rise as materials pricing rises and incomes rise. Employers are struggling to par the market pay as salaries and minimum wage increases. There are rumors of former copper mines re-opening as copper prices remain north of $4.00. Steel, concrete and fuel prices continue to rise quicker than the consumer price index. Overall, the future of the Arizona economy seems much stronger compared to other states as migration, copper and lithium mining, and out of state company relocations rise. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

||||||

RSS Feed

RSS Feed