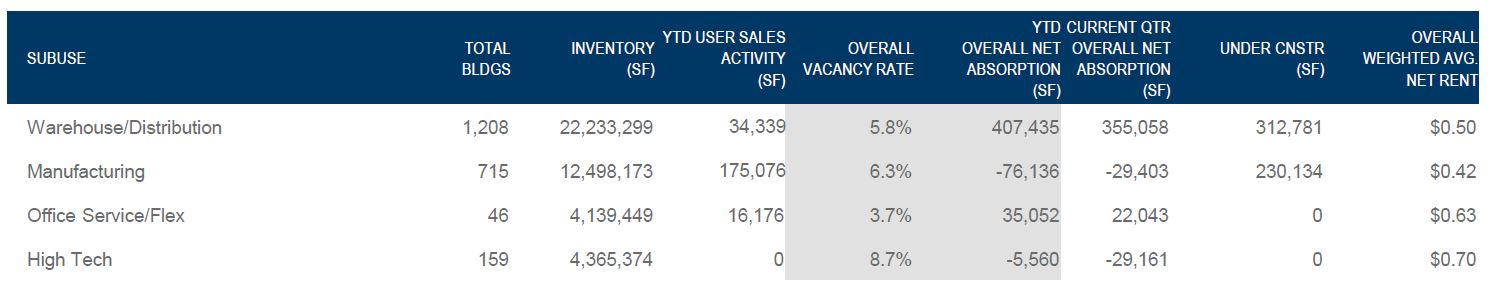

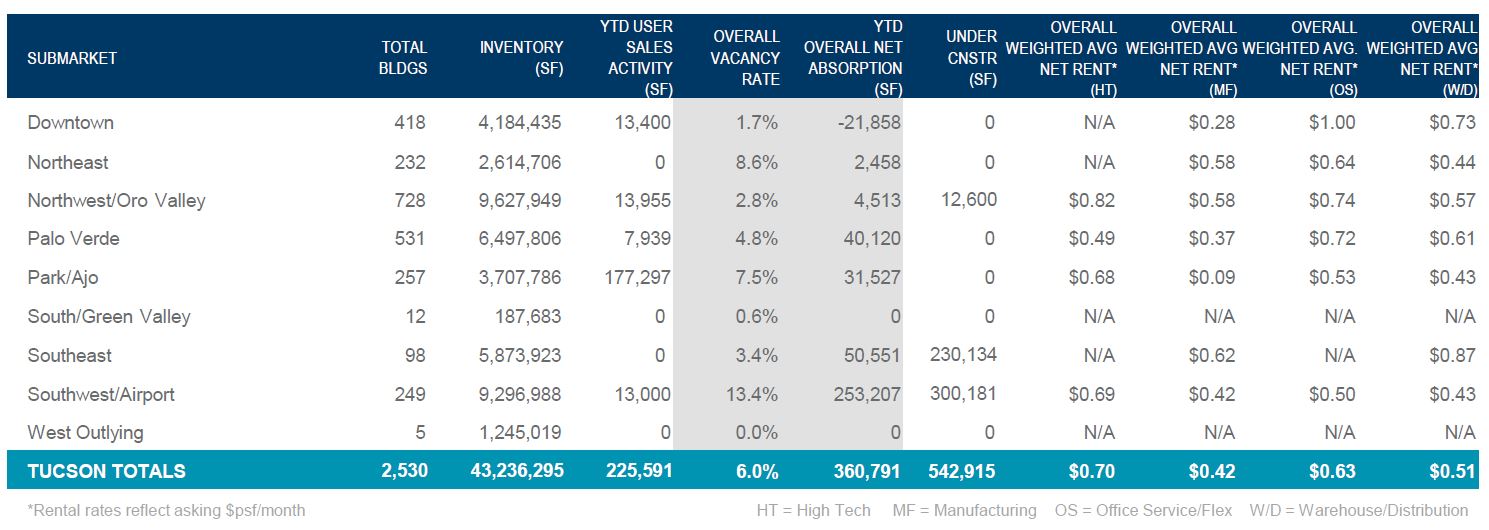

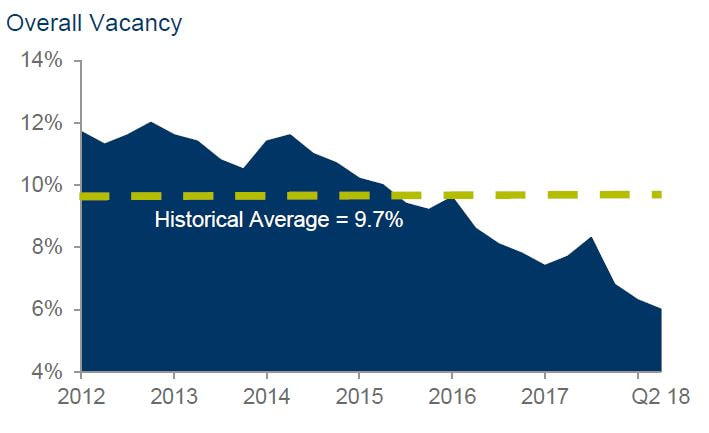

Tucson’s unemployment rate now sits at a healthy 4.6% level (US Average 4.1%). Similarly, population growth approximates 1.5%, while personal incomes are also making strides, rising at a 4.3% clip. Arizona continues to outpace the national average in these key indicators. Expansionary fiscal policy poses a potential risk to this continued prosperity at a time when labor markets are significantly tightening. This policy may result in increasing inflation, which is being carefully monitored heading into 2019. The industrial market in Q2 2018 continued the positive trend experienced in recent years, with strong and consistent momentum. Market-wide industrial vacancy improved to 6.0%, approaching the historic low of 5.0% prior to the crash in 2008. Gains were headlined by the mining, defense and logistics sectors. Hexagon Mining, Caterpillar, Raytheon, Amazon are all names we have become accustomed to hearing in Tucson, and with them come construction, long-term, and indirect jobs, subcontractors, and general business enthusiasm. Of note, medical marijuana-related businesses are finding traction in the industrial sector, as the industry begins to come of age. Mid-year sales volume was quite strong, posting double the volume seen in 2017 in the first half of the year. Average sale price per sf was on pace for its highest level since 2008. Distressed asset sales have all but evaporated, and plans are in motion for new speculative construction in the industrial sector. Expect an increase in speculative development, marking a return to health for the Tucson market. Harsch Investments announced plans to build a multi-tenant distribution building in the airport submarket, and rumors of new, speculative construction in other submarkets are afoot. In the mining sector, we look forward to Hudbay’s Rosemont project, and the further economic impact on the region. With continued construction, employment, and overall positive economic indicators, we project that the industrial market will stay strong through the remainder of 2018 and beyond. Aerial photo is 10831 N Mavinee, a new listing in the Oro Valley market. -4,677 SF -Owner will build out to tenant's need -Flex, lab, office use

0 Comments

Cushman & Wakefield | PICOR

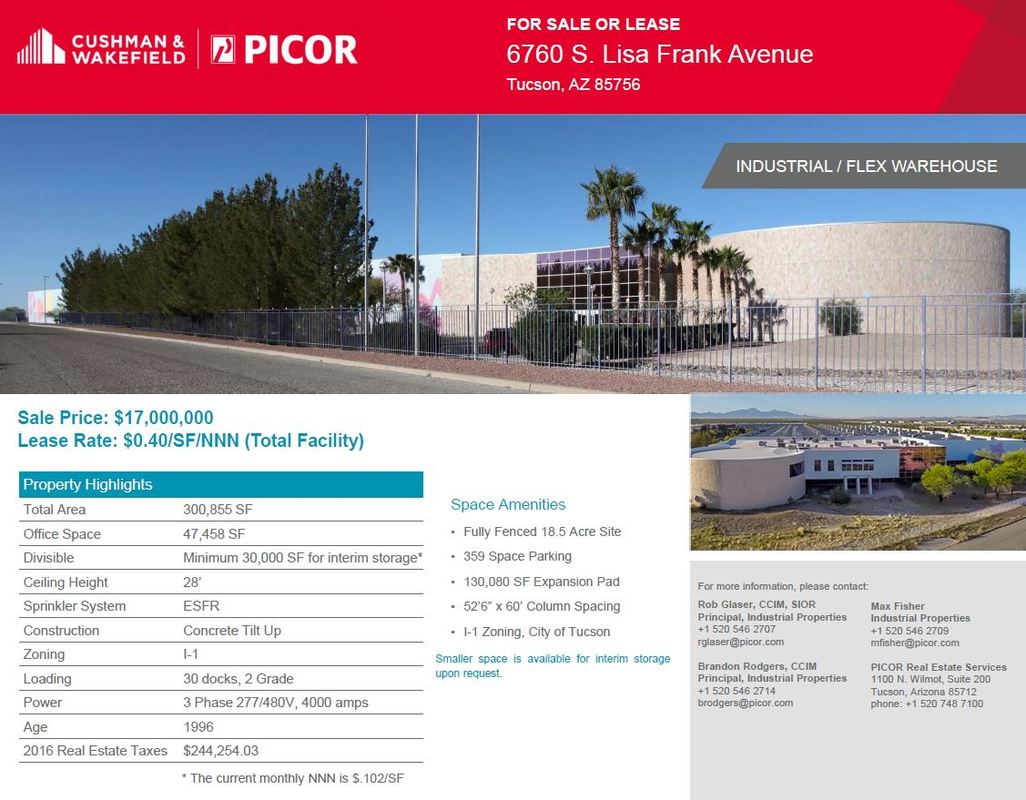

460-470 W Roger Road Industrial/Flex Center: 20,308 Rentable SF Sale Price: $1,440,000 ($71.00 PSF) Purchase Date: August 21, 2018 Property Highlights •14 units of flex suites • Grade loading •On market for one week •90% leased •Call for more detail Current Vacancies: 1,640 SF, 50% office 50% warehouse 1,640 SF, 75% office 25% warehouse About: Max specializes in the leasing and sale of industrial and business park properties, including flex/research and development, warehouse and distribution, and manufacturing space. As a native Tucsonan, Max inherently understands what makes the community thrive. He has been active in the Tucson real estate market since 2012, and his strong community ties and industrial focus make him a standout in the commercial/industrial arena. He is known for his strong focus on relationships, tenacious work ethic, and his communication and negotiation skills. Max has completed 58 transactions so far this year. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed