|

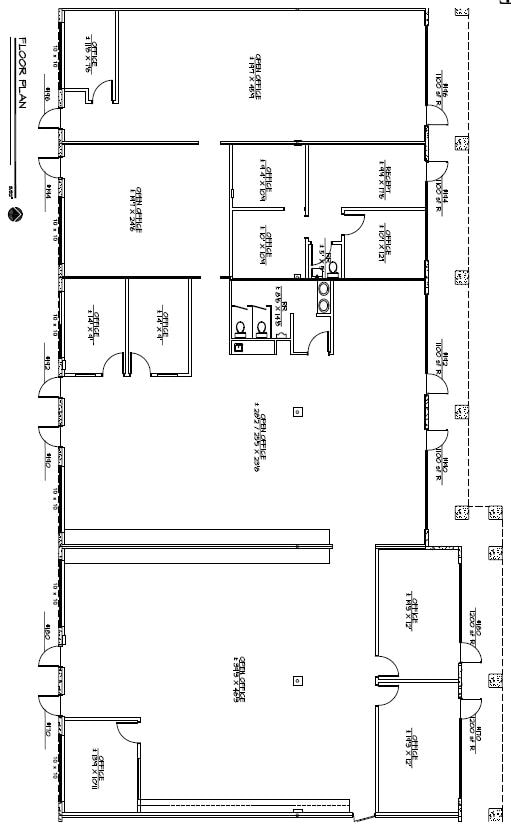

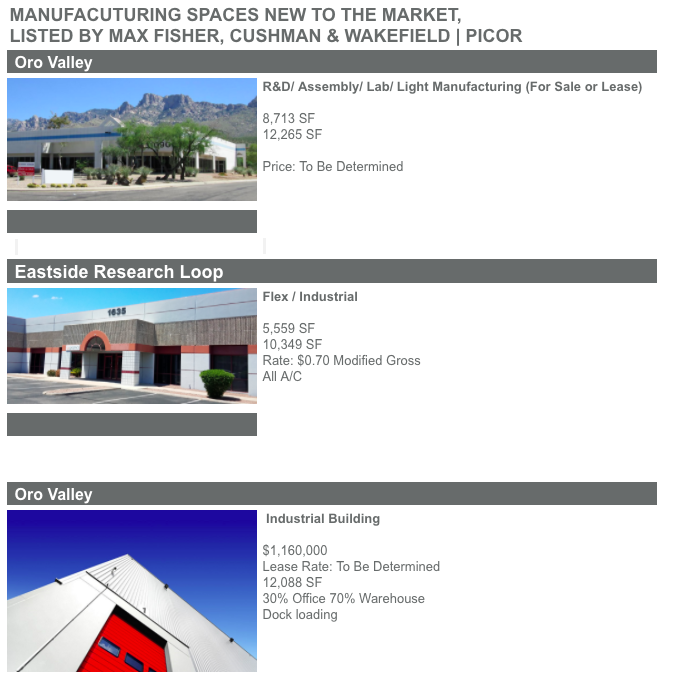

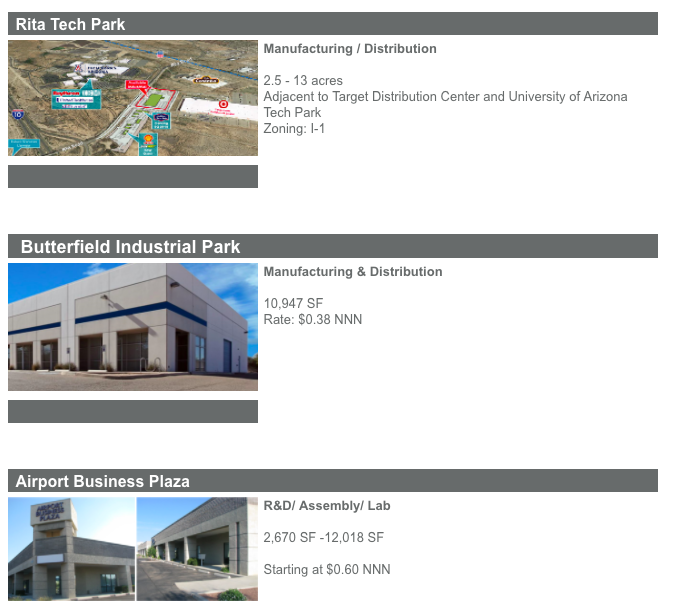

All properties listed by Max Fisher within the past month Please email [email protected] for any brochures detailing any of the below properties

0 Comments

Manufacturing

Mining, aerospace and Defense manufacturing continues to prosper and grow in the Tucson market. Another quarter of positive net absorption (131,500 SF) resulted in a 6.8% vacancy rate, under 7.0% for the first time since Q2 in 2008.This represents a full percentage point improvement year over year. 166,954 SF of manufacturing space was absorbed in 2017. The strongest submarkets in Tucson are the northwest and Downtown markets. As the Downtown and Northwest markets have around 3% vacancy we will watch as demand grows further north into Marana with new construction and further south towards Tucson International Airport and Vail, effectively filling already vacant buildings to the South and East. Side Notes: Reports say the recent closure of Rockwell Collins, formerly B.E. Aerospace was closed in efforts to centralize operations after the recent acquisition. Prediction: Manufacturing will continue to grow in 2018 and the vacancy rate will drop another point by the end of the year. Defense manufacturing, mining, plus expansion, and housing market growth, will be the two main drivers behind Tucson's manufacturing growth. Lease rates and values are expected to climb at a steady rate in 2018. Most recent manufacturing deals done by Max Fisher: Manumach Incorporated Arizona Powder Supply Incorporated Dynamic Manufacturing Wetmore EDM Systems Most recent manufacturing deal rates ranged between $0.55/SF/Mo MG - $0.72/SF/Mo MG |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed