|

Today the March inflation rate was announced at 8.5%. This comes on the heals of a 2% interest rate hike within the past few months. The market has yet to react negatively to the rise in interest rates. We can associate the lack of interest rate reaction to sustained home building, the increase in E-commerce and steady migration from California and other densely populated cities and states.

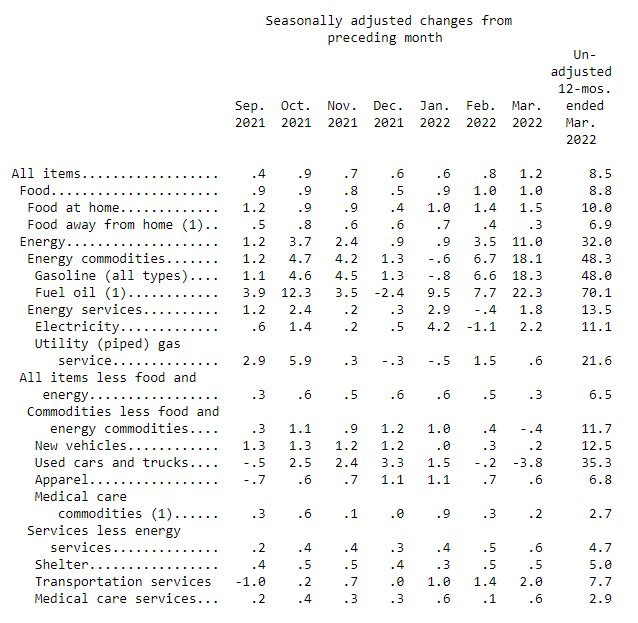

CPI per the Bureau of Labor Statistics Energy Commodities: 48% Utility Gas Service: 21.6% Used Cars & Trucks: 35.3% Food: 8.8% Shelter: 5% The industrial market has seen user building and land sales increase by 40-70% since January 2021. Industrial lease rates have also climbed significantly as recent institutional investors have entered the Tucson market, purchasing industrial property and business parks from local investors. Out of state investors are purchasing property at record low cap rates. To justify the low returns, out of state investors are raising lease rates at least 20%. There have even been reports of 80% increases from out of state investors in lease rates for incubator buildings. Upcoming redevelopment projects of industrial property are also a key factor in the existing supply. There are many factors that aren’t showing signs of price leveling, especially the energy and housing sector. The increase in interest rates may make development of rental units more challenging for the developer/investor which can taper new builds. Recent land acquisitions are foreshadowing increased development both in the housing market and industrial market as inventory remains very low. The labor shortages and price increases for materials and commodities doesn't help new supply as key commodities remain high. Copper remains close to $5, lumber is up more than 300% over the past 5 years, natural gas has more than doubled in the past year, and gasoline is up 66% in the past year. Cost of materials and labor shortages have put pressure on businesses, especially small businesses. This has created a trend of business owners shutting their businesses down or selling their businesses to larger corporations as larger corporations can pass the increases onto the consumer easier and absorb challenges better than small businesses can. The war in Ukraine combined with OPEC denying production increases , and the lack of US energy production signals a very challenging future for energy prices and a tough road ahead for those businesses that consume larger amount of gasoline, diesel, natural gas and electricity. The natural gas prices are also affecting the local economy as most of our electricity is dependent on natural gas, not coal. We can expect significant electricity rate increases on a local level due to natural gas price increases and potential shortages. So what’s next? I don’t know but I tend to be an optimist. In my opinion, Arizona is one of the best positioned states right now as migration continues, supply chain is moving from overseas to Arizona after covid shutdowns disrupted the supply chain, copper demand continues to increase as the EV, electronics and solar market grows rapidly. Global stagflation could be next on the horizon but Arizona may offset those affects with the factors listed above. The president's recent expressed interest in an executive order which would cut red tape and increase production for EV materials mining such as copper, cobalt, lithium, nickel, and graphite could significantly boost the Arizona economy.

1 Comment

|

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed