|

As the death of malls, departments stores, and other retail businesses looms, the industrial market begins to strengthen day by day. With consumer consumption increasing and retail declining, products still have to be manufactured and distributed. The retail decline is essentially cutting out one more stop in the distribution chain, making products more affordable and putting the manufacturing, distribution, and sales process solely on the industrial market’s back.

Why is this real estate revolution happening? E-commerce, social media marketing, yelp, etc. Ten years ago Barnes and Noble was the place to buy books. Today Amazon is the place to buy books. Here are my predictions for the next ten years…….. Predictions: E-commerce will lead to more stores in industrial business parks that will never even see a customer. For example, I just leased a space in an industrial business park to a company that distributes health products. Their sales are generated 100% online through social media and they can cut their costs by paying half as much for an industrial suite as a retail location. Prices for products will decline as businesses cut out the middle man (retail) and go straight to the consumer through amazon, social media, google, etc. Industrial rental rates will rise as demand for retail shifts into the industrial market. Industrial real estate investors' profits will grow. Take out will locations will become more prevalent and will no longer need the retail exposure. Take out venues similar to Sauce, Pei Wei, etc will move into less expensive locations in business parks that are away from the beaten path. Consumers will be in in touch with these off the beaten path take out spots through yelp and social media. By: Max Fisher, Industrial Properties Broker. Cushman & Wakefield | PICOR

0 Comments

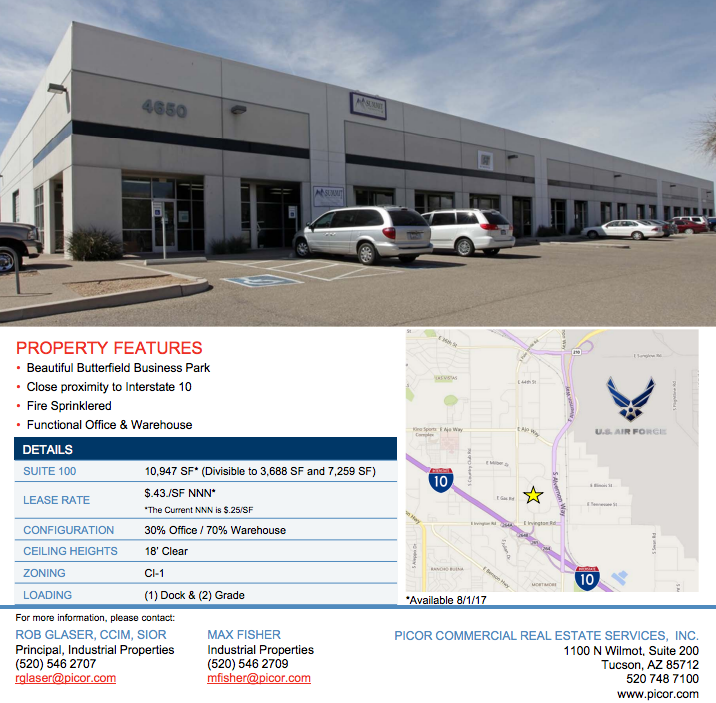

As we enter the second half of 2017 the market is picking up with vacancy rates dropping .5% from last quarter. As vacancy rates are dropping and demand continues to increase we are predicting rental rate increases, especially in the northwest and downtown industrial markets. Within the next year or two as rates start the climb we will see developers start to break into the Tucson market. It's an exciting time in the market and we look forward to a healthy industrial market. Here are a few new Fisher listings, 1660 S Research Loop 1,240 sf-18,564 sf4606 S Overland 4.01 Acres (Butterfield Business Park) $525,0003780 E 44th St (750 sf-1,650 sf)3955 E Speedway 844 sf-2,315 sfOld West Business Park (Ina & I-10) 1,500 sf-1,650 sfINDUSTRIAL – 2112 N. DRAGOON ST., TUCSON Skyline Assayers & Laboratories leased 3,000-square-feet at 2112 N. Dragoon St., Suites 1-3 in Tucson, from Rich Rodgers South, Inc. Max Fisher, with Cushman & Wakefield | PICOR, represented the landlord and the tenant in this transaction. INDUSTRIAL – 6894 N. CAMINO MARTIN, TUCSON Grace Retreat Foster Care and Adoption Services Corporation leased 1,500-square-feet in Old West Business Park, 6894 N. Camino Martin, Suite 100 in Tucson, from Camino Martin Partners II, LLC. Cushman & Wakefield | PICOR Industrial Specialists handled this transaction. Max Fisher represented the tenant, and Brandon Rodgers, CCIM, Principal, represented the landlord in this transaction. INDUSTRIAL – 2112 N. DRAGOON ST., TUCSON Arison Construction, LLC leased 1,000-square-feet at 2112 N. Dragoon St., Suite 24 in Tucson, from Rich Rodgers South, Inc. Max Fisher, with Cushman & Wakefield | PICOR, represented the landlord and the tenant in this transaction. INDUSTRIAL – 3959 E. SPEEDWAY BLVD., TUCSON Draeger Safety Diagnostics, Inc. leased 794-square-feet of office/warehouse space in Central Point Business Plaza, 3959 E. Speedway Blvd., Suite 317 in Tucson, from Central Point Tucson, LLC. Jeff Zellet, Commercial Specialist with Cushman & Wakefield | PICOR, handled this transaction. To read the entire report, click the link below realestatedaily-news.com/tucson-lease-report-july-3-7-2017/?utm_source=MadMimi&utm_medium=email&utm_content=We+do+the+Research+-+You+do+the+Deals%21&utm_campaign=20170707_m140258552_We+Do+The+Research+-+You+Do+The+Deals%21&utm_term=Tucson+Lease+Report+July+3-7_2C+2017 In our Tucson Industrial Market we have two main types of leases, NNN and MG (Modified Gross). Over the past month I have had prospective tenants very confused with NNN lease rates and in some cases, upset. The NNN lease rate is typically around $.20 lower than the more common, Modified Gross lease rate and can be deceiving in some cases and that's why it's helpful to understand what you're getting with each type of lease.

In simplest terms, the NNN lease rate (in most cases) does not include property taxes, common area maintenance charges, building insurance, water, and trash. The Modified Gross lease rate (in most cases) does include, property taxes, building insurance, common area maintenance charges, water, and trash. After paying the NNN rent the tenant will have to pay NNN fees (common area maintenance charges, water, trash, property taxes, insurance, etc). A tenant that occupies 10,000 SF of a 100,000 SF building will pay for 10% of the total NNN fees. In the Tucson Industrial Real Estate Market NNN leases are much more common in larger spaces (5,000 SF and up) than smaller spaces. Here's an example of a couple lease rates that you may see; MG rate: $.68 per sf NNN rate $.48 per sf with NNN fees at $.20 per sf Notes, the NNN lease rate doesn't always advertise the NNN fees so always make sure you request the NNN fees before signing a lease. Have any questions? Email me at [email protected] |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed