|

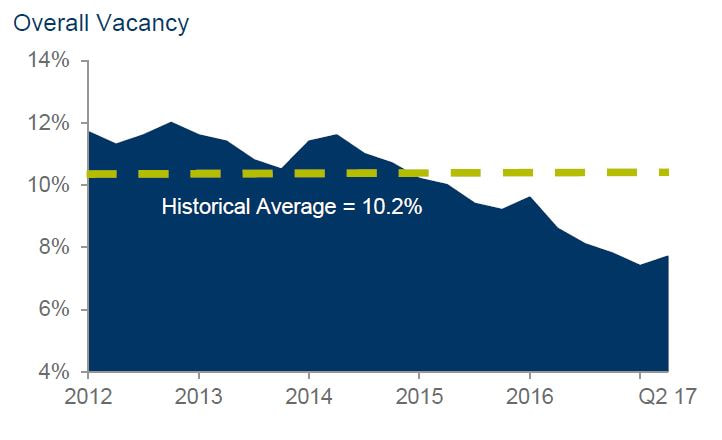

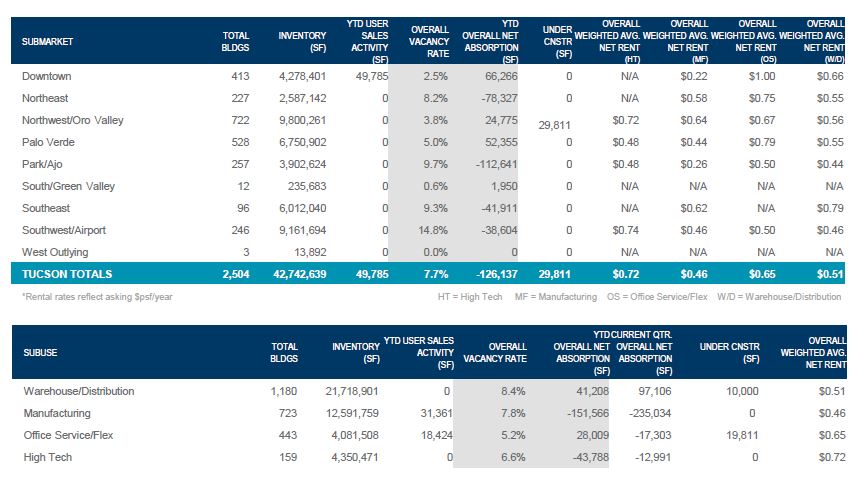

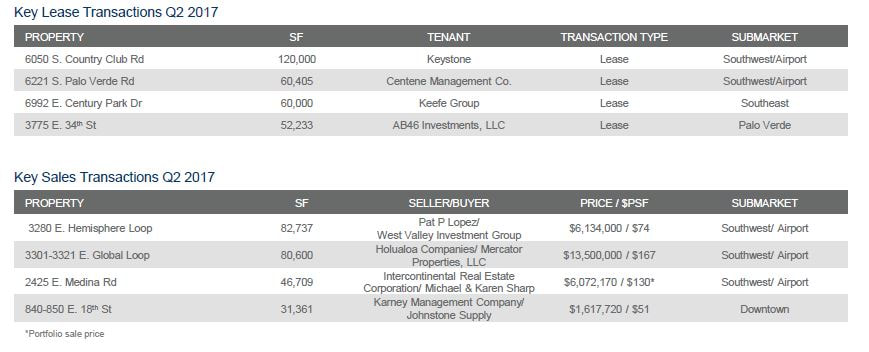

Economy National consumer sentiment remains favorable amid signs of positive economic direction. Arizona continues to outpace the nation in job creation, with an unemployment rate back to a level last seen before the Great Recession. Tightening labor markets are translating into faster wage and income growth which should boost retail sales. Overall, the outlook calls for the state’s economy to accelerate modestly in the near term. Job growth in the Tucson metro area has accelerated significantly due to recent announcements from large in bound employers. While single family home prices rose 6.0% nationally, the one-year price changes for the first quarter 2017 were 8.0% for Phoenix and 5.4% for Tucson. According to Bright Futures Real Estate Research, permits for new home construction in metro Tucson in May were up 51.8% from year earlier levels. Market Overview The market is more balanced between landlords and tenants as vacancy has dropped to 2006 levels. Despite the slight uptick in vacancy at the end of the second quarter, the Tucson industrial market continues to see strong activity in most size ranges. Rents are rising and the unusually high tenant concessions experienced during the downturn are disappearing. An exception to this is buildings and space over 50,000 square feet, where activity is still not occurring. Construction is starting to be impacted by the shortage of trade workers. This will only become more challenging as the industrial market continues to improve. Twenty eight industrial properties sold during the second quarter, with seven investment sales and twenty one sales to users.The overall average price per square foot was $62.96.Five sales were sold to investors based on the income generated, while eighteen were sold to users for occupancy.The other two sales were sold to buyers whose companies occupied a portion of the two-tenant building purchased. Outlook Absorption continues to be strong as companies expand and new companies announce relocations to Tucson. Vacancy will be lower in smaller spaces under 10,000 square feet and rents will continue to rise. Activity will accelerate in larger spaces with improved absorption in this area. Land activity has been anemic for a number of years and will remain so until sale and lease prices approach the cost of new construction.  Do you know someone who has an interest in leasing, buying, or selling commercial real estate in Tucson? Please send them my way! Max Fisher Commercial Broker PICOR Commercial Real Estate Services Direct: +1 520 546 2709 Mobile: +1 520 465 9989 Fax: +1 520 546 2799 [email protected] 1100 N. Wilmot, Suite 200 Tucson, AZ 85712 | USA

0 Comments

realestatedaily-news.com/tucson-lease-report-aug-7-11-2017/https://realestatedaily-news.com/tucson-lease-report-aug-7-11-2017/

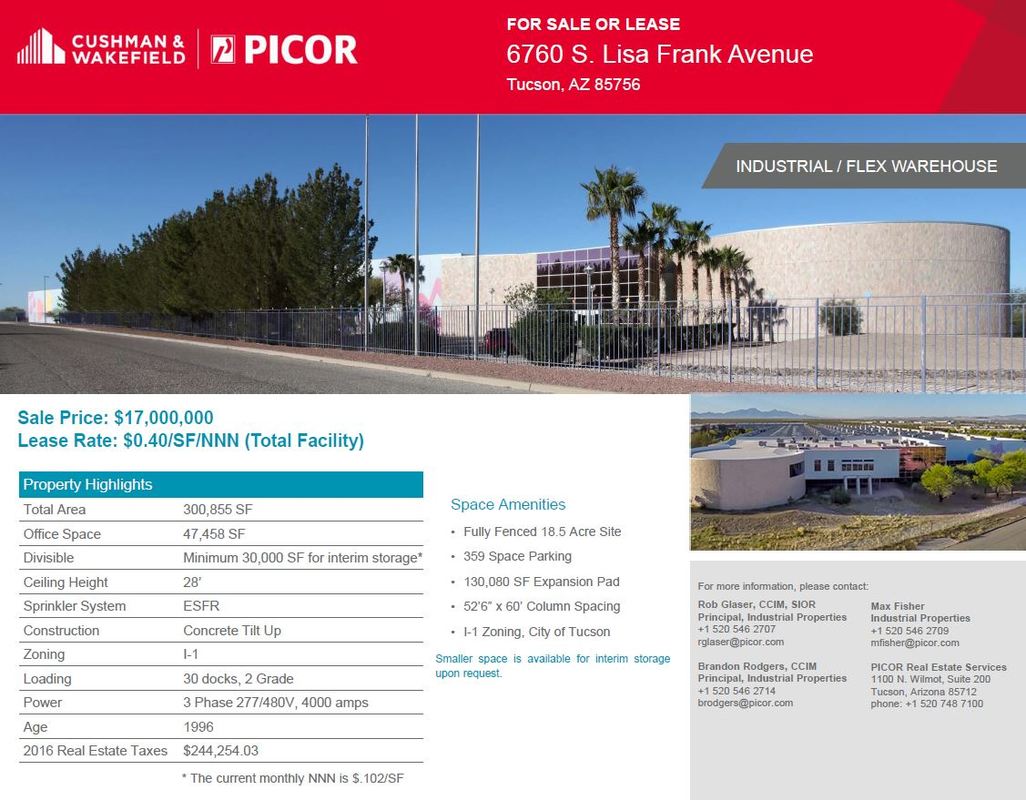

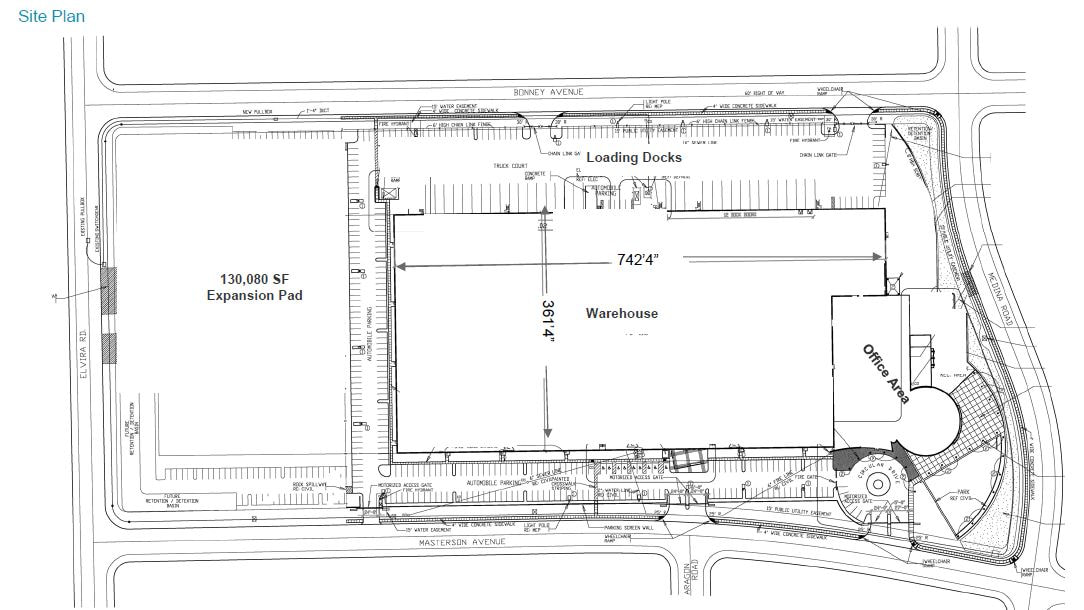

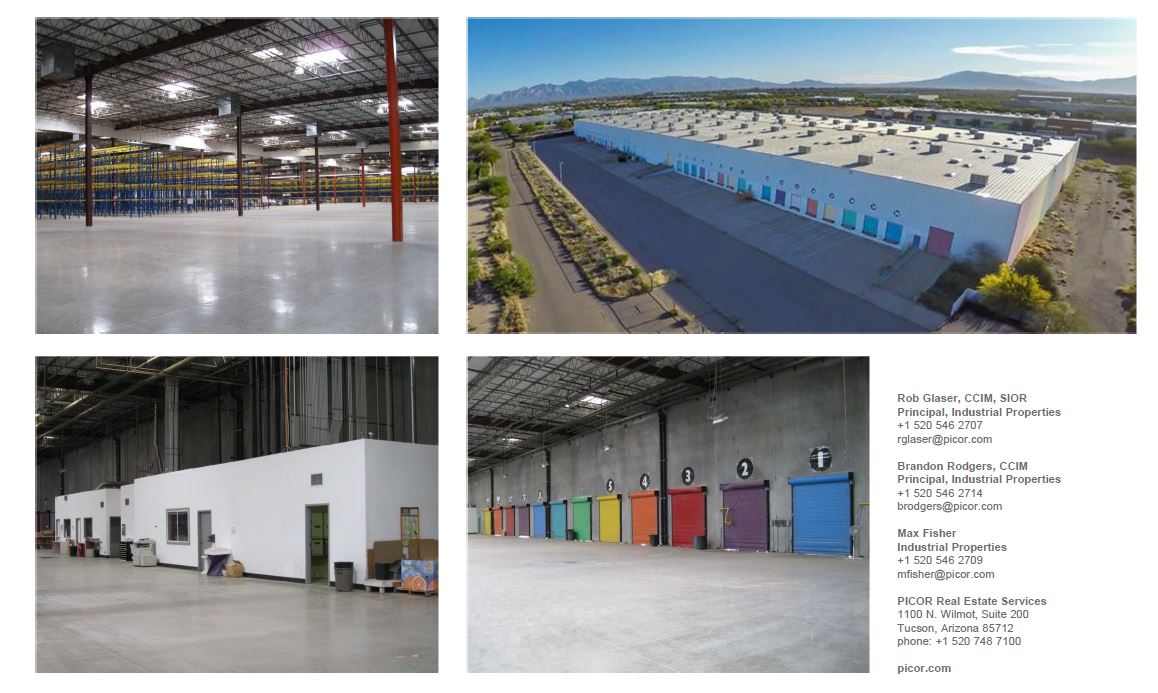

Max Fisher, Rob Glaser and Brandon Rodgers List the Lisa Frank Building ($17,000,000 300,855 SF)8/8/2017 Space Amenities

• Fully Fenced 18.5 Acre Site • 359 Space Parking • 130,080 SF Expansion Pad • 52’6” x 60’ Column Spacing • I-1 Zoning, City of Tucson Call Max Fisher, Industrial Properties for more info 520-465-9989 |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed