|

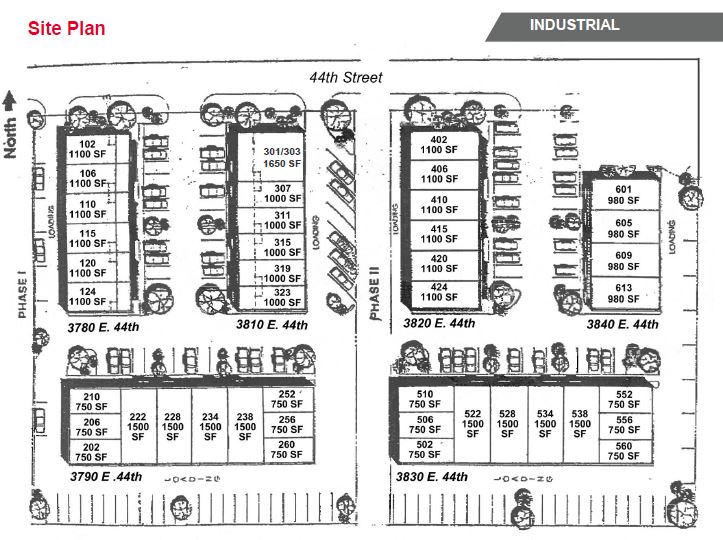

3780-3840 E. 44thStreet

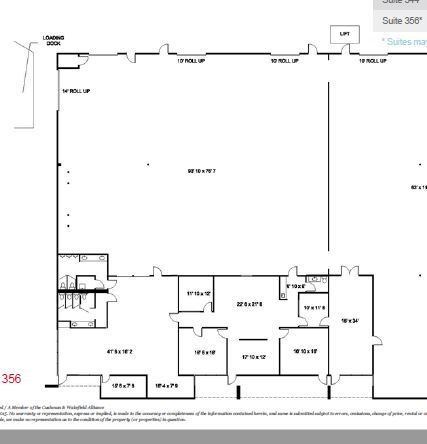

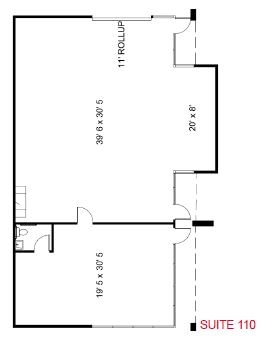

Tucson, AZ 85713 Property Features •Abundant parking (94 spaces in park) •Grade level roll-up doors •Monument signage •Power: 3-phase; 100 Amp •±14 ft. clear height •Zoning: CI-2, Pima County Availabilities SF Available: 750-1,650 SF Suites Lease Rate: $0.60/SFMG* Use: Office/ Warehouse / Shop *Tenant pays additional $45.00/month CAM and Pima County leasing tax of 0.5%, plus own utilities. Listed by Max Fisher, Cushman & Wakefield | PICOR

0 Comments

http://blog.cushwake.com/americas/retail-newsline-what-amazons-acquisition-of-whole-foods-really-meansa-conversation-with-ben-conwell-and-garrick-brown.html

ECONOMY

Arizona’s economy closely follows the national trend, calling for continued growth through 2017. Arizona expects continued gains in jobs, residents, and income at a rate exceeding the national average. Recent announcements by Caterpillar, Vector Industries, Raytheon, Comcast and Ascensus are strong indicators of this trend. Tucson is expected to add over 10,000 jobs in the period from Q2 2016 through Q2 2017. While focusing on past and current performance, businesses in the region will maintain a watchful eye toward broader factors such as regulatory policy, immigration, trade, value of the dollar, and potential federal tax reform. As a border state, positive trade relations with Mexico remain crucial to our economy. Finally, the impact of the new minimum wage ordinances recently passed in Arizona, among other states, will reveal a clearer picture of what to expect in the coming months. OFFICE Year over year improvement in office market metrics continues, with a second consecutive quarter of overall market vacancy hovering at a seven-year low. Positive absorption of 31,000 square feet (SF) contributed to a 10.6% vacancy. Increased hiring by employers in engineering and financial services is expected to bring meaningful positive momentum for professional office absorption and eventual upward pressure on lease rates. RETAIL As predicted, Tucson’s retail market saw a significant increase of 235,808 square feet (SF) positive net absorption. This improvement is almost six times more than the 40,993 SF absorbed in Q4 2016 and accompanied delivery of nine new buildings totaling 235,958 SF. In the past four quarters, a total of 621,286 SF of new retail space has been delivered, consistent with the observed increase in retail space demand and activity predicted in our most recent quarterly report. MULTI-FAMILY In Tucson's apartment market, the vacancy rate for conventionally-operated, stabilized units decreased by 0.35% from the previous quarter, while improving 0.28% from one year ago to 6.52%. Eight of Tucson’s 15 submarkets experienced occupancy gains, with the greatest improvements occurring in Tucson Mountain Foothills (-2.12%) and South Tucson/Airport (-2.09%). The Northwest Tucson submarket posted the lowest fourth quarter vacancy of 5.24%. The submarket with the second lowest vacancy was the Catalina Foothills at 5.45%, followed by East Tucson at 5.50%. The highest vacancy rate of 17.56% occurred in the Southeast Tucson submarket. INDUSTRIAL Tucson’s industrial market continued forward progress in the first quarter of 2017. Net positive absorption of about 50,000 square feet (SF) improved the overall vacancy rate to 7.4%, Tucson’s lowest mark since Q3 2008. The submarket with both the lowest vacancy and the largest inventory at nearly 10 million SF, was Northwest Tucson, with a vacancy rate of 4.3%. With occupancy above 92.5% and no speculative space under construction, competitive pressure will result in upward movement in rents. A 25% increase in rents must occur for new construction to be financially viable. This is clearly the next step in Tucson’s industrial recovery. While no leases were completed in the largest vacancies during the quarter (those over 100,000 SF), activity in larger spaces was at its highest level in recent history. S Brothers, Inc. leased 1,440-square-feet in Clairemont Plaza, 1660 S. Research Loop, Suite 138 in Tucson, from Clairemont Partners, LLC. Cushman & Wakefield | PICOR Industrial Specialists handled this transaction. Rob Glaser, SIOR, CCIM, represented the landlord and Max Fisher represented the tenant in this transaction. Asking lease rate: $0.67 SF/MO Industrial Gross

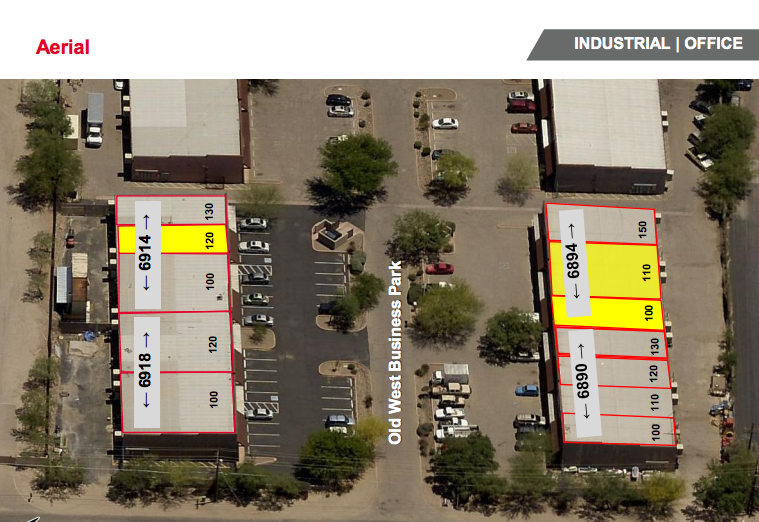

To read more about Tucson leases click the link below realestatedaily-news.com/tucson-lease-report-june-5-9-2017/ Max Fisher, Cushman Wakefield | PICOR represents Sampson's Plumbing in the lease of 6894 N Camino Martin. Camino Martin is an industrial business park in Marana. Contact Max Fisher at 520-546-2709 for more info in regards to Marana Industrial Space. Click the link to view all Tucson May 22nd-26th leases https://realestatedaily-news.com/tucson-lease-report-may-22-26-2017/

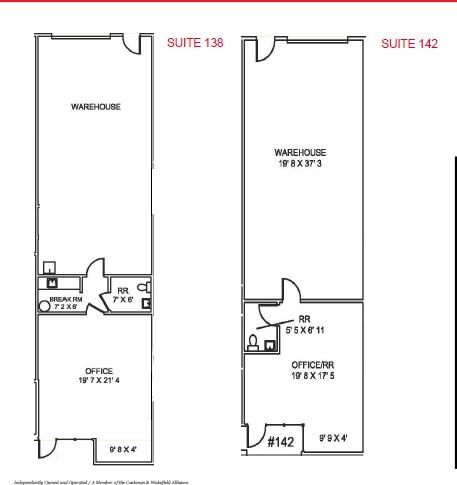

Max Fisher and Rob Glaser, Cushman & Wakefield | PICOR have listed the recently purchased Clairemont Business Park, 1660 S Research Loop. Clairemont Business Park consists of 5 buildings for a total of 69,986 SF. Units range from 1,240 SF to 18,564 SF. Reliance Property Management, the new owner has renovated most units and 2 leases have been executed with in thew past 2 weeks to The Screamery, an ice cream manufacturer and S Brothers Inc, a residential restoration company.

Current tenants include American Law Label, Smith Performance Center, S Brothers Inc, Blackrock Brewers, The Screamery, Superior Auto Repair, Indura Power Batteries, and Meridian Surveying. Clairemont Business Park is zoned I-1 and functional for both research & development, and warehousing. Contact Max Fisher at 520-465-9989 for more info or to arrange a showing. Cross streets: 22nd/Pantano Zoning: I1 Lease Rate: $.62-$.72 MG

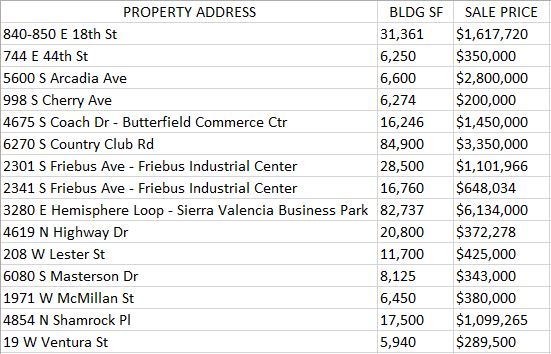

The following is a list of the 5,000 SF and larger Tucson industrial buildings which have sold in 2017. Tucson’s industrial market continued forward progress in the first quarter of 2017. Net positive absorption of about 50,000 square feet improved the overall vacancy rate to 7.4%, Tucson’s lowest mark since Q3 2008. While no leases were completed in the largest vacancies during the first quarter (those over 100,000 SF), activity in larger spaces was at its highest level in recent history. We are very committed to our clients’ success in the marketplace and would appreciate the opportunity to work with you on successfully marketing or selling your commercial property. If you are thinking of selling or leasing your property, or would like more market information, please call me. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed