|

| | |

South Euclid Business Park

The Railyard

American Eat Co

Dragoon Business Park

Barrio Brewing

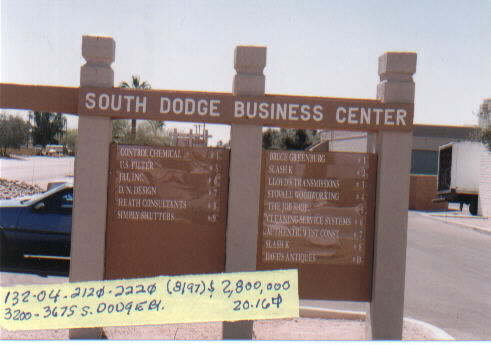

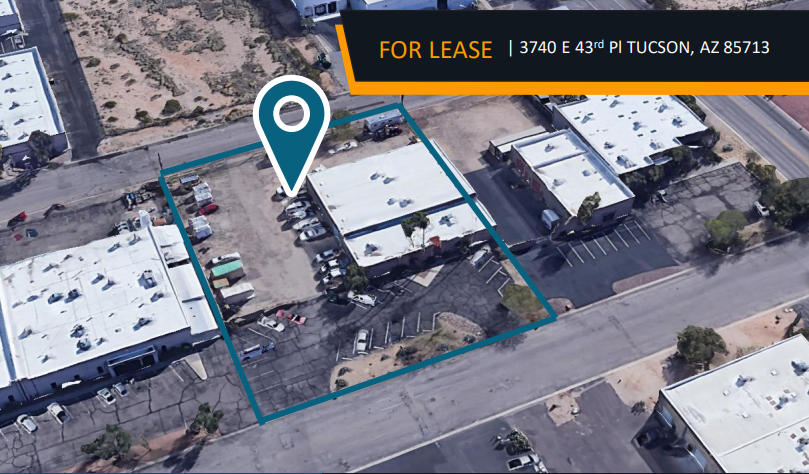

South Dodge (Caylor Industrial Park)

Famous Sam's at Ruthrauff Commerce

| | |

Old photos either came from the Pima County Assesor's website or friends and family

Put together by Max Fisher, Industrial Real Estate Broker with Cushman & Wakefield | PICOR

Northwest Tucson

Fenced yard

Sprinkled

20% Office / 80% Warehouse

37,026 SF (0.85 Acres)

AC Office / EVAP Warehouse

Listed by Max Fisher of Cushman & Wakfefield | PICOR

The Tucson solar market seems to continue to grow and prosper. In addition to solar install growth, Solar Research & Development continues to grow throughout Tucson. With 286 days of sun in Tucson, the solar industry is very appealing.

As the virus continues to damage the economy, the housing market seems to feel little effects, including housing improvements like solar and remodels. There continues to be multiple offers on listings and renters are having trouble finding housing, especially affordable housing. This high demand, low supply scenario creates a perfect storm for housing developers. This increased development directly benefits the industrial market as the developers need warehouses and industrial yards to store building materials. There is also a huge demand for trades related businesses that serve the housing market like solar, plumbing, electrical, and HVAC. Those trades related businesses typically occupy small to mid-sized industrial property.

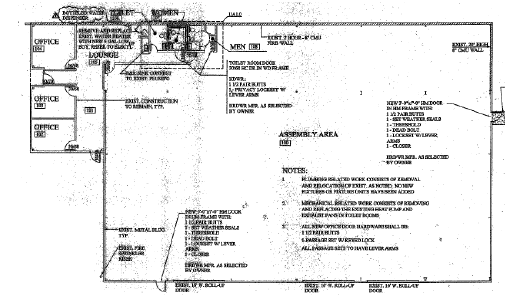

Most of the tenants in this building were small bay distribution related.

Despite the massive economic effects from the virus, the Tucson industrial market continues to stay strong. The vacancy rate is 6.1% and we expect that rate to remain around 6-6.5% over the next year. As of May, 16, in Arizona alone, 72,523 PPP loans were approved, totaling over $8.6 Billion dollars. Not sure of the amount received in Tucson but this significant amount of money has provided a backstop or life line to a lot of small business in Tucson. This is a reason why there has not been much change to the occupancy rate in Tucson to date. We also expect small bay industrial to remain strong as most tenants are considered “essential”, commodity driven and not affected by closures. Small bay industrial spaces less than 10,000 SF are 95% filled with lease rates increasing 10-20% over the past two years. Larger bay industrial spaces have smaller rent increases and are steadily filling up, mostly driven by the building materials market and Ecommerce distribution.

We can attribute this continued industrial market strength to three main economic drivers; distribution, the mining industry, and the housing market.

Author

Max Fisher, Industrial Properties Broker

Archives

April 2024

March 2024

November 2023

September 2023

May 2023

January 2023

November 2022

August 2022

July 2022

May 2022

April 2022

November 2021

September 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

May 2018

April 2018

March 2018

February 2018

December 2017

October 2017

September 2017

August 2017

July 2017

June 2017

May 2017

RSS Feed

RSS Feed