|

https://realestatedaily-news.com/tucson-lease-report-february-12-16-2018/

0 Comments

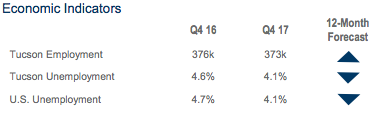

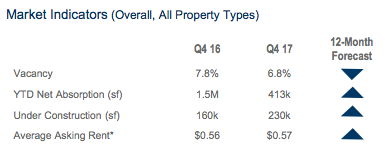

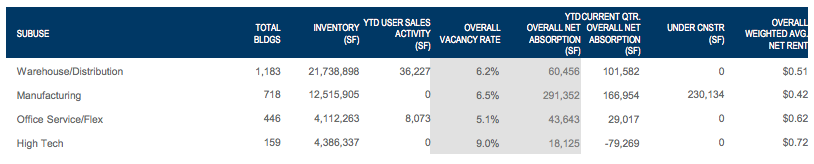

Manufacturing Tucson's manufacturing market seems to be growing at a quick and steady pace. Aerospace and defense manufacturing continues to prosper and grow in the Tucson market. Another quarter of positive net absorption (131,500 SF) resulted in a 6.8% vacancy rate under 7.0% for the first time since Q2 in 2008. This represents a full percentage point improvement year over year. Most recent manufacturing deals done by Max Fisher; Manumach Inc (11,218 SF, doubling in size) Arizona Powder Supply Inc (5,242 SF) Dynamic Manufacturing (2,100 SF) Wetmore EDM Systems (1,400 SF) Economy Tucson’s economic health generally tracks that of Arizona and the nation as a whole, which bodes well for our region. Personal income nationally in November was up 3.8% over a year ago. This is good news because inflation over that period was up only about 2.0%. According to Eller College economists, the Tucson MSA job data preliminarily reported by the Bureau of Labor Statistics is likely understated by thousands of jobs, and once adjusted in the spring for actuals, will reflect what is felt in the marketplace: that employment has steadily grown every quarter since Q3 2015. Housing permit activity was up 16.7% year-overyear through November, while median home prices are up 12.2%, all trending very favorably after several years of limited growth. Market Overview The Tucson Industrial Market continued strong momentum as the year 2017 closed out. Another quarter of positive net absorption (131,500 SF) resulted in a 6.8% vacancy rate, under 7.0% for the first time since Q22008. This represents a full percentage point improvement year over year. Average sales prices per square foot have grown 24.9% in two years, from $54.81 in 2015 to $68.45 in 2017. Sales volume in 2017 ticked up slightly from the year prior to $66.3 million. Industrial sales remain strong, with continued interest in investment and owner/user properties. The top sales for this quarter included several investment properties, the largest of which was 110,026 SF building in the southwest/airport submarket. In concert with strong occupancy, rental rates continue to improve. Rents for space under 20,000 SF are expected to rise in the range of 7%-10% in 2018 with virtually no concessions. Rents for space over 20,000 SF will be flat and won’t rise until larger spaces/buildings are absorbed. While rates have not improved enough to justify speculative construction market wide, look for development opportunities in stronger submarkets in the year ahead. Outlook With some demand for land, the sale of freestanding small to intermediate buildings, and the leasing of small to intermediate spaces, all aspects of the market are hitting on all cylinders with the exception of larger availabilities (i.e. those over 200,000 SF). Once one or more of these larger buildings are absorbed, the vacancy rate could dip below 5.0% and open the door for all aspects of new development. Our expectation is that this occurs during 2018. Max specializes in the leasing and sale of industrial and business park properties, including flex/research and development, warehouse and distribution, and manufacturing space.

|

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed