|

Contact Max Fisher, Warehouse Specialist 520-465-9989 or [email protected] Property Highlights

Contact Max Fisher, Warehouse Specialist 520-465-9989 or [email protected]

0 Comments

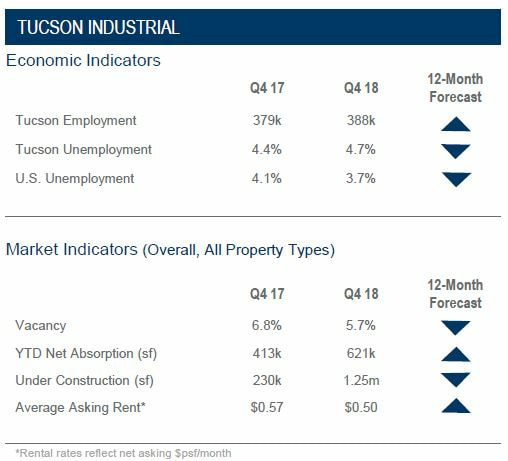

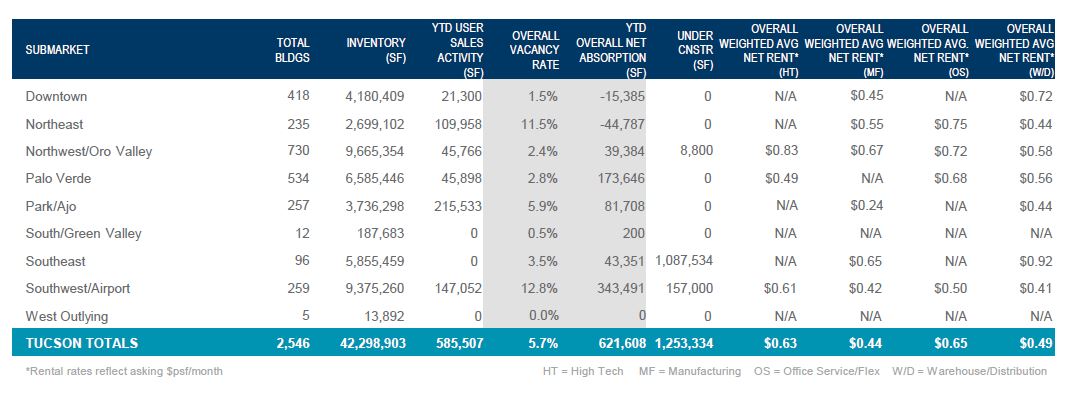

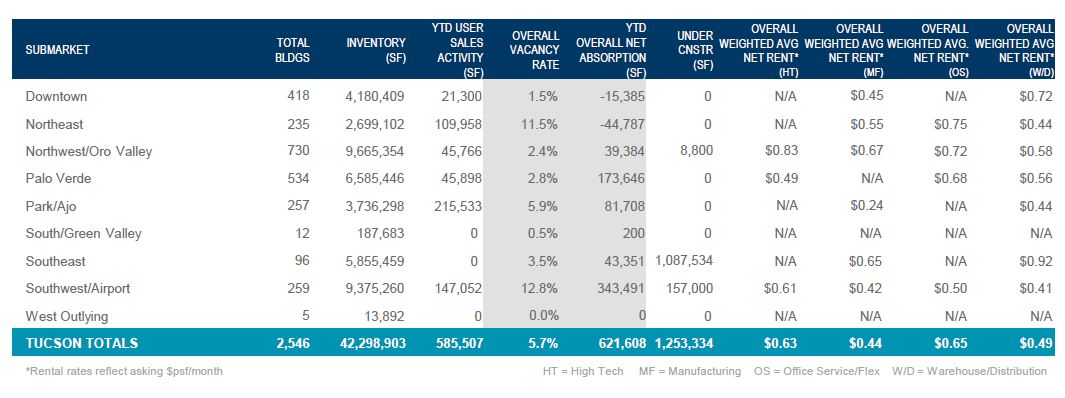

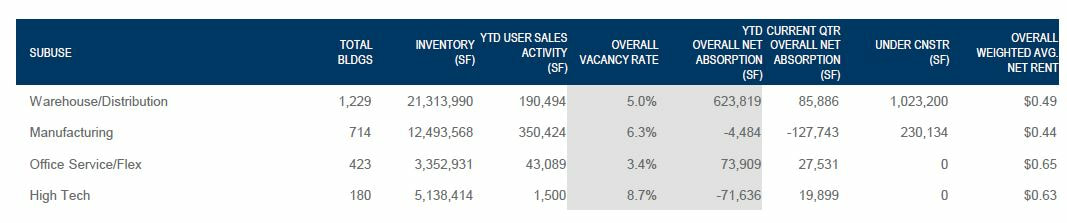

Max Fisher specializes in the leasing and sale of industrial and business park properties, including flex/research and development, warehouse and distribution, and manufacturing space Economy The Tucson economy continued to grow robustly in 2018. Total nonfarm employment is up 3.1% over the year with the manufacturing sector leading with a massive 7.9% gain. Aggregate retail sales posted a strong 4.5% gain as consumer sentiment remained buoyant despite the stock market moving into bear territory and the possibility of an inverted yield curve. Tucson personal income rose 5.4% over the year and population grew by 1.0%. At 2.2%, inflation in Arizona matches that of the nation. A recession resulting from an inverted yield curve occurs 18-24 months after the point of inversion. Accordingly, 2020 would be the earliest recessionary onset, and any economic pullback is expected to be minor. To boost development and investment, 28 census tracts in Pima County were approved as Opportunity Zones, enabled by the 2017 tax laws. City/County coordination allowed the region to maximize both the chance of approval and the greatest economic impact. Market Overview Positive momentum continued its five-year trend in 2018 in Tucson’s industrial market, with vacancy improving to 5.7%, cut in half from its highest point in recent years. At year end, vacancy was lowest in the city center at 1.5% and highest in the Southwest/Airport area at 12.8%.Net absorption was 50.4% stronger than in 2017, and thanks to Amazon’s two projects, space under construction has quadrupled year over year. Significantly, Amazon is entering the market with an 850,000 square foot (sf) distribution center under construction in the southeast sector and a new 50,000 sf service center in the southwest. While down, the decrease in average asking rents is likely attributable to higher absorption of more functional space, as actual effective rents are seeing pressure to rise. With inventory tight, one developer broke ground on a new 157,000 sf building with intermediate bay sizes to fill the market void. Others began positioning with land acquisitions pending further rent inflation to support new construction. Cap rates improved for sellers as demand for quality investment options gave rise to highly-competitive buyer activity. At $150.3 million, 2018 sales volume was at its peak since 2007 and more than doubled each of the previous nine years. Outlook Rents for spaces under 5,000 sf will rise 10-15% in 2019.Expect growing demand among service companies and other construction-related trades. Even at a historically strong occupancy rate, Tucson’s market has room to improve, as several high profile, larger buildings over 200,000 sf are ripe to be absorbed, essentially bringing Tucson to full occupancy.With vacancy across the region expected to drop below 5.0% in 2019, market dynamics will shift, and new development will occur as rents justify new construction.Key local employers in mining and aerospace/defense sectors like Raytheon have quietly expanded their employment bases in Tucson, and we have seen a rise in prospects considering bringing jobs to the region Max Fisher specializes in the leasing and sale of industrial and business park properties, including flex/research and development, warehouse and distribution, and manufacturing space. As a native Tucsonan, Max inherently understands what makes the community thrive. He has been active in the Tucson real estate market since 2012, and his strong community ties and industrial focus make him a standout in the commercial/industrial arena. He is known for his strong focus on relationships, tenacious work ethic, and his communication and negotiation skills. Max completed over 80 commercial transactions in 2018.

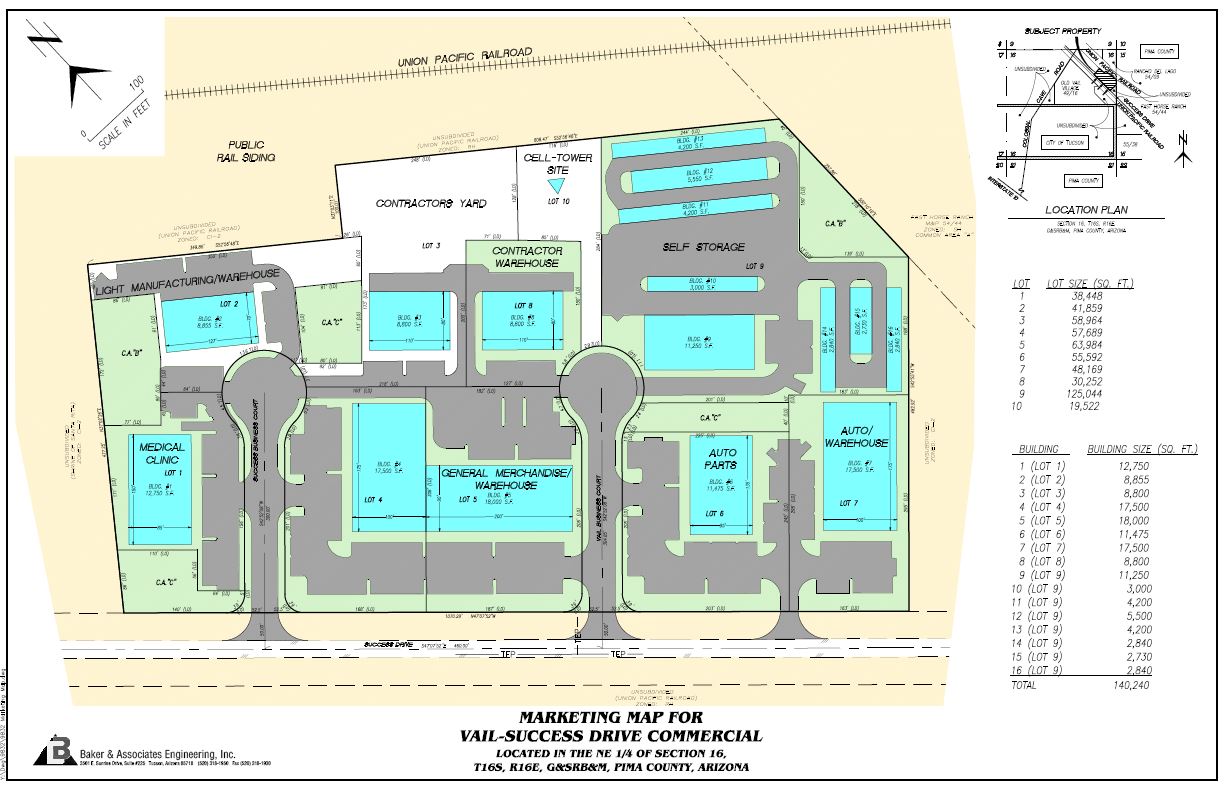

AFFILIATIONS AND ACHIEVEMENTS Certified Commercial Investment Member (CCIM) – Member Juvenile Diabetes Research Foundation (JDRF) – Advocate and Public Speaker Father’s Day Council - Steele Children's Research Center – Executive Board Member Young Professionals Network Tucson 2015-2016 – Chair PARTIAL CLIENT LIST Presson Equity Harsch Investment Properties Diamond Ventures Rich Rodgers Investment Inc Aspen Companies Foothills Business Ventures Property Highlights

Listed by Brandon Rodgers and Max Fisher, Cushman & Wakefield | PICOR. For more info call or text Max Fisher at 520-465-9989 or email [email protected] |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed