|

Property Highlights

0 Comments

Residential sales are down. Buyer activity seems to be at a 5 year low.

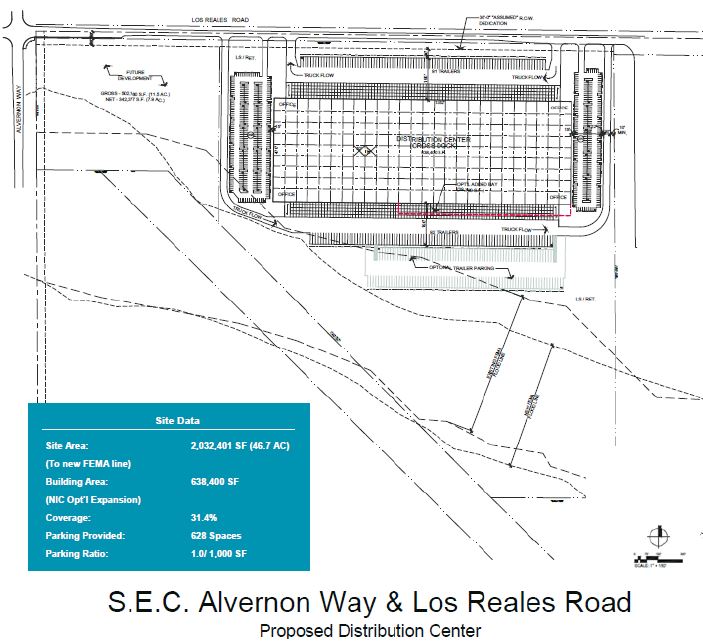

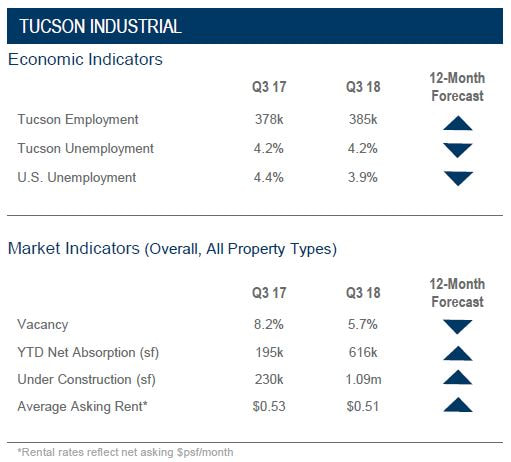

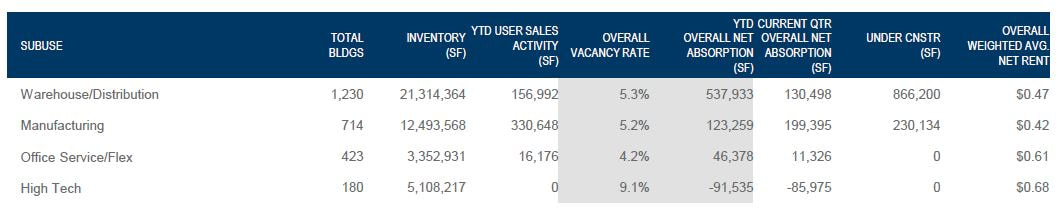

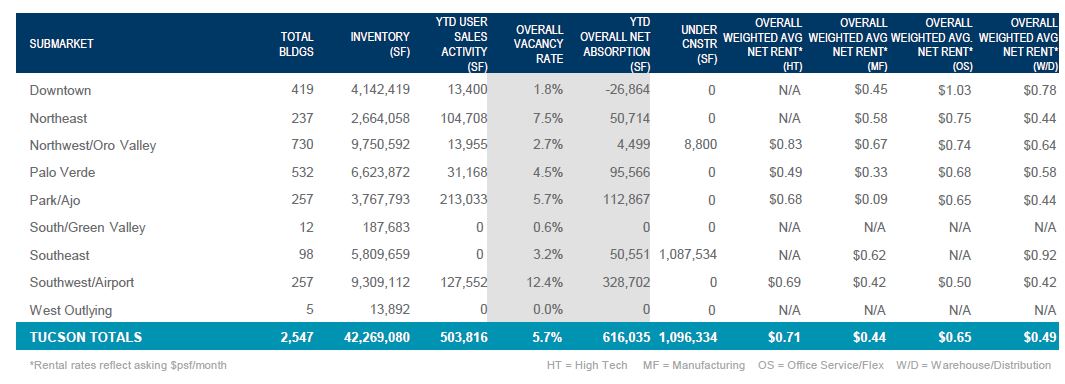

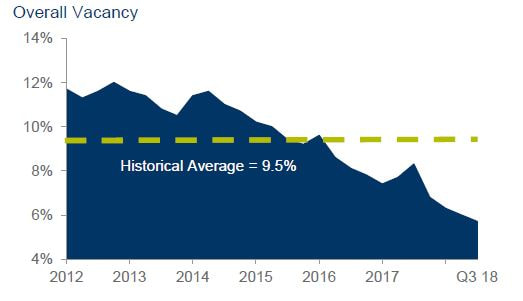

On the flip side, residential sales prices are strong. Office, industrial, retail, and apartment sales and leasing are strong so what’s really going on? The Tucson residential market is in a cycle we’ve never experienced before due to changes in our inventory, technological changes, worries about another recession, politics, a growing job market, a shortage of skilled trades labor, rising materials costs, and other changes that we haven’t experienced before. Sales are down because inventory is low, trades labor is tough to find, and sellers are asking for higher prices because the market is hot. New builds aren’t being built fast enough. Tucson’s industrial market is growing at a rapid rate due to the demand for construction contractors, distribution for products sold online, and a strong manufacturing and distribution market. The vacancy rate is below 7% which is leading to higher rental rates and a demand for new industrial spec development (which isn’t happening). We may run into a real problem if the housing market and industrial market continue to sustain growth because all industrial vacancies will be filled. Higher rental rates and a shortage of labor will be a tough obstacle for businesses to overcome. The office market continues to sustain a slow growth while retail is taking an entirely new shape, big box retailers like Sears will continue to close shop while new retail tenants such as urgent cares, entertainment and restraints continue to fill vacancies. Investment sales, similar to the residential market are starting to slow down due to lack of inventory. There remains to be plenty of cash in the market for investment sales but investors are struggling to find deals. What’s next? My prediction is that we are at the beginning of a development cycle for all markets (residential, office, industrial, retail, and apartments) because of the new industry coming into Tucson (Raytheon, TuSimple, Caterpillar, Mining South of Tucson, and Aerospace Manufacturing). All of the new employees moving to Tucson need housing which will effectively spur new housing developments and apartment developments. Builders, their sub-contractors, mining companies, Raytheon and other aerospace and defense manufacturing vendors will need warehouses, offices and yards to house their equipment, material, and staff. That will spur a larger demand in the office and industrial market. This new increased demand will entice developers to start building new office and industrial buildings. I believe we are at least a few years out from a slow-down and our next slow down (which will come) will not be as damaging as 2008’s downturn. Which areas of Tucson will be affected the most? Downtown, West Tucson, Marana, and Vail. Why? Most new companies and growing companies are relocating to areas near I-10 for accessibility reasons and proximity to Downtown, which is where all of the employees want to be. Looking to invest in real estate? Purchase property near downtown or I-10. Economy Employment in Metro Tucson has continued to improve, ending the third quarter of 2018 with an increase in jobs of 6,700 from a total of 378,500 in the third quarter of 2017. The Tucson economy will continue this trend of steady growth due to the new industries and large employers that have been attracted to the area. Market Overview The industrial market for the third quarter 2018 continued its strong momentum. Overall vacancy has dropped to 5.7%, well below the historical average of 9.5% and the highest occupancy experienced since 2007. Vacancy is lowest in the office service/flex sector and highest for high-tech space. The majority of the vacancy is in larger spaces over 50,000 square feet (sf). Year-to-date absorption of 616,035 sf was driven by continued expansion in logistics, mining, building materials, and defense-related businesses. Building sales activity is strong with functional inventory selling quickly. Volume through the third quarter 2018 of $105 million well outpaced 2017’s full-year total of $67 million. Average sale prices per sf are up 12% over 2017, rising from $68 to $76 per sf. That being said, investment transactions have slowed due to a lack of sale inventory. Land sale activity is showing signs of life but remains low relative to pre-2007 levels. The general industrial inventory of existing properties suffers from a degree of functional obsolescence. Those projects with ample parking, loading, ceiling heights, and contemporary design will see the strongest absorption and appreciation in rents and pricing. Significant projects under construction include a 230,134 sf cross-dock rail-served facility at Century Park and Amazon’s 857,400 sf distribution center scheduled for completion in Q2 2019. Outlook

Absorption will continue a strong and positive trend. Expect to see meaningful activity in larger blocks of space and buildings. The economic development pipeline is the strongest it has been in several years. Rents in spaces under 10,000 sf will continue to rise with the most significant rent increases in lease space under 3,000 sf. Speculative construction will return to the market. Land sale activity will continue to improve as confident business owners choose to control their costs when faced with rising lease rates. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed