|

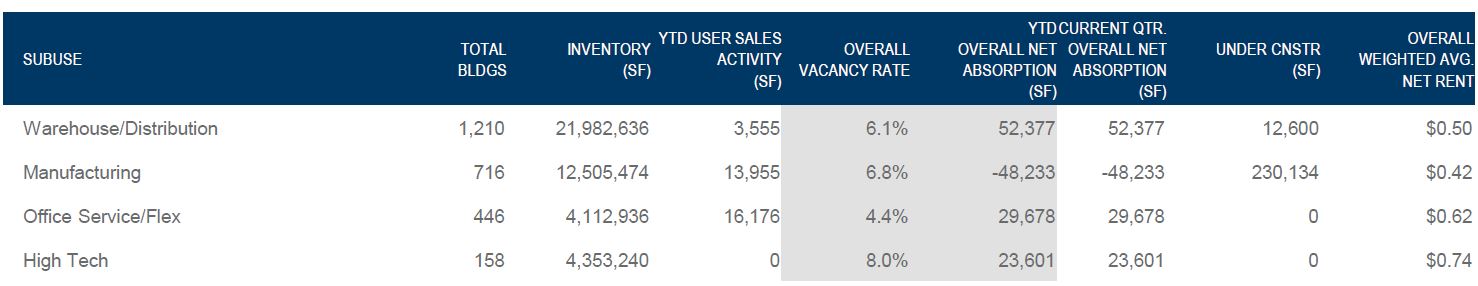

-The increase in small business growth across Tucson can be attributed to the expanding local economy and housing market, defense manufacturing growth, retail companies moving into industrial business parks, and an overall healthy economy. -Small industrial businesses between 1,000-5,000 sf seem to be doing well and expanding faster than we have seen within the last 10 years. Because of this improved small business growth multi-tenant business parks with vacant space under 5,000 sf are raising rental rates 2-5%. -Absorption of industrial space continued during the first quarter of 2018, with 57,423 square feet (sf) of positive net absorption for the quarter. -Properties smaller than 100,000 sf have a vacancy rate of 4.7% Economy Arizona posted healthy job growth when as predicted, the Bureau of Labor Statistics revised data indicating that Arizona employment actually grew 2.4% during 2017 versus a previously reported 1.7%. Tucson job growth for the year was also revised, up to 1.5% and early in Q1 2018, employment has held steady. The national trend of tight labor markets, impacting pricing and space demands, set the tone for Tucson to follow suit. In the short term, this may be good news as rental rates rise, but in the long-term threatens growth if labor markets stay tight, deliveries stagnate and the federal funds rate continues to rise. In February, the average sales price of Tucson homes rose 3.3% to $249,095 while new single family housing permits were up 13.7% year-over-year. January retail sales in the Tucson MSA were up 6.9% over the prior January. Market Overview Absorption of industrial space continued during the first quarter of 2018, with 57,423 square feet (sf) of positive net absorption for the quarter. This reduced the overall vacancy rate to 6.3% in the 42.9 million square feet (msf) of industrial buildings. Interestingly, there are 57 properties of above 100,000 sf that do not divide to a smaller size, with a vacancy rate of 12.6%. That means the remaining 2,500 properties of 31.8 msf are 4.7% vacant. This should be driving new construction, but rental rates and sale prices have not increased enough to justify this additional cost. Looking at a 20,000 sf new building to be built on a lot in Butterfield, the estimated construction costs would be $125 per square foot (psf), resulting in rents of close to $1.00 psf per month triple net. Existing buildings are priced in the $60.00 to $70.00 psf range, with monthly lease rates of 65¢ to 70¢ psf triple net for modern, functional buildings in Tucson. This gap needs to close for new construction to occur in any quantity. Only four small parcels of land sold during the first quarter, with planned construction for each parcel. Eleven buildings sold during the quarter, including three leased investments, and the rest owner occupied after the sale. Outlook Small industrial businesses between 1,000-5,000 sf seem to be doing well and expanding faster than we have seen within the last 10 years. Because of this improved small business growth multi-tenant business parks with vacant space under 5,000 sf are raising rental rates 2-5%. The increase in small business growth across Tucson can be attributed to the expanding local economy and housing market, defense manufacturing growth, retail companies moving into industrial business parks, and an overall healthy economy. Well located smaller industrial businesses can expect rental rates to rise at least 2% per year. Below is a list of every deal (Company & Industry) Max Fisher did in the First Quarter of 2018

0 Comments

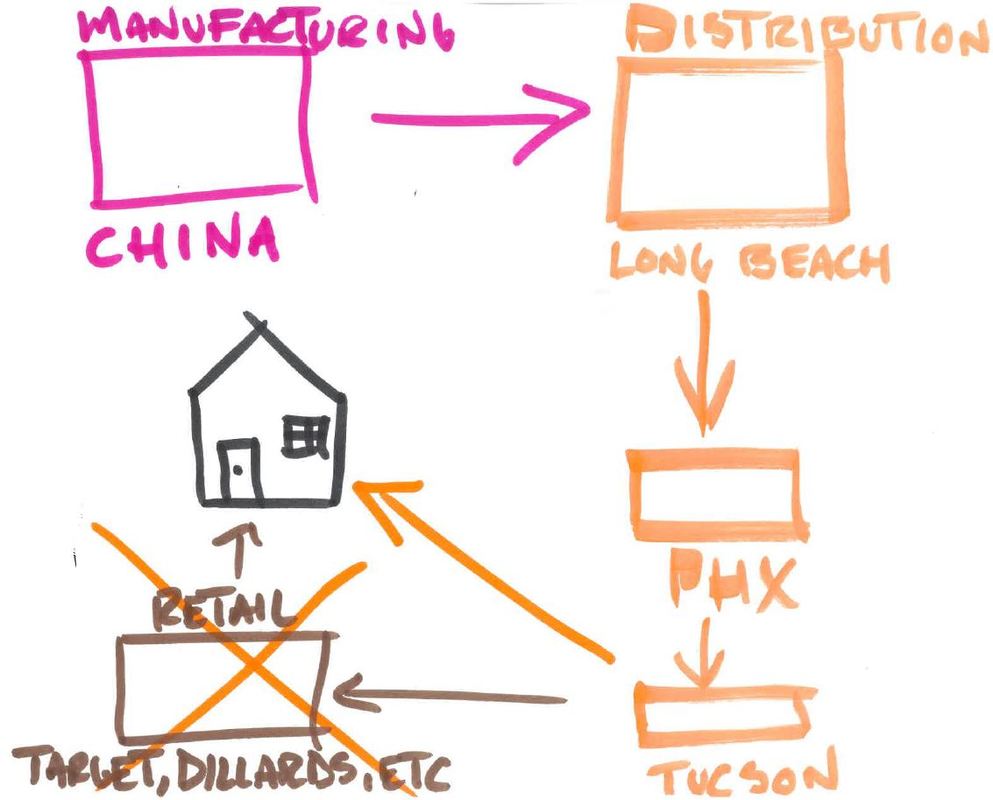

Recently Amazon announced their distribution project, 875KSF warehouse center project at Port of Tucson, and while the footprint will be 857KSF, the overall building area is 2.3MSF. https://realestatedaily-news.com/that-massive-project-at-port-of-tucson-yeah-its-amazon/ Instead of storing product at a retail store like target, the ecommerce company can ship directly from the warehouse or consumers can pick up the product from the warehouse. Now, for a lot of businesses there’s no need for retail anymore because the consumer identifies the company/product on Amazon, Google, Yelp, etc as opposed to driving down the street. A perfect example is gyms in industrial business parks. Gyms in industrial business parks are very common now because the rent is cheap and the consumer finds the gym on google, yelp etc, not driving down the street. Lower rent means cheaper prices which will create competition for retailers, effectively disrupting their business and bankrupting them (Sports Authority)……..Bye Bye LA Fitness

This effectively creates more demand for industrial property/warehouses which means rates rise, investors prosper. Do you want to invest in industrial real estate? Contact Max Fisher, Industrial Properties Specialist and Investment Sales Broker. Recent Ecommerce Distribution deals Max Fisher has done, CBO Solutions Bebe Bartoons Thrive and Grow Gardens MSE Supplies Diversigroup In our Tucson Industrial Market we have two main types of leases, NNN and MG (Modified Gross). Over the past month I have had prospective tenants very confused with NNN lease rates and in some cases, upset. The NNN lease rate is typically around $.20 lower than the more common, Modified Gross lease rate and can be deceiving in some cases and that's why it's helpful to understand what you're getting with each type of lease.

In simplest terms, the NNN lease rate (in most cases) does not include property taxes, common area maintenance charges, building insurance, water, and trash. The Modified Gross lease rate (in most cases) does include, property taxes, building insurance, common area maintenance charges, water, and trash. After paying the NNN rent the tenant will have to pay NNN fees (common area maintenance charges, water, trash, property taxes, insurance, etc). A tenant that occupies 10,000 SF of a 100,000 SF building will pay for 10% of the total NNN fees. In the Tucson Industrial Real Estate Market NNN leases are much more common in larger spaces (5,000 SF and up) than smaller spaces. Here's an example of a couple lease rates that you may see; MG rate: $.68 per sf NNN rate $.48 per sf with NNN fees at $.20 per sf Notes, the NNN lease rate doesn't always advertise the NNN fees so always make sure you request the NNN fees before signing a lease. Have any questions? Email me at [email protected] |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed