|

Pre-2020, Tucson industrial leasing would slow down in the summer. Leasing remains strong although not like 2021 levels with multiple tenants bidding on the same vacancies. The leasing demand seems to be coming in waves and this summer packs strong demand. In June alone, I closed 9 transactions.

Overall vacancy has increased while the vast, vast majority of vacancy remains in bigger bays. Vacancy below 50,000 SF warehousing remains at all time lows while more industrial product is set to be demolished and re-developed this year than is built. Demand is robust and diverse, ranging from housing market materials suppliers and subcontractors to manufacturing, distribution and lab space. The biggest drivers for Tucson’s economy right now are housing market construction, mining and defense. We have seen a lull in the manufacturing market as demand seems to be softening as manufacturing jobs also soften. Demand in the Northwest market remains the strongest for bays less than 20,000 SF while demand for bigger bays remains the strongest in the Palo Verde and Tucson Airport sub-markets. One interesting new trend that we are noticing is demand or lack of demand related to crime. Vandalism, drug use and burglaries are on the rise and tenants are leaving buildings where they experience crime and are moving to more desirable areas. Historically, some of the areas had little to no crime. Ironically, heavier industrial markets are seeing less crime and more demand from tenants relocating from higher crime areas.

0 Comments

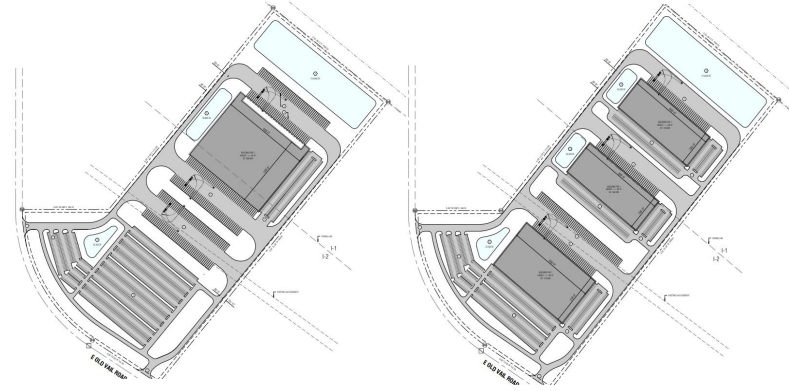

158 acres zoned heavy industrial next to the Port of Tucson, Amazon and new 200,000 SF+ Becton Dickson. Property includes water rights and engineering plans. The land has been subdivided into smaller 1-3 acre lots. Electric is at the lot line and tests have been conducted for septic. This is a great opportunity for an investor to continue with the subdivision and sell off improved lots, develop or build to suit for one large user. Recent sale for a 1.5 acre industrial lot at Valencia/Kolb was $5 per SF. Shaded acreage has a recorded development easement so development is limited but can potentially be used as industrial outdoor storage, solar, self storage. Verify with Pima County development services. Click below to download the brochure

1.13 acre industrial parcel fully fenced and paved in the highly sought after Northwest market now for sale.

-Less than 1 mile to I-10 -Industrial zoning, City of Tucson -3 phase power -Extra covered area with two shipping containers included 2023 W Price St Tucson AZ 85705 In most markets throughout the US, industrial vacancy is on the rise but it’s important to understand which part of the market vacancy is rising in. Over the past 5 years during this development boom, the vast majority of industrial was built in the large bay markets, 100,000 SF+ bays. In markets that don’t have excess land to build, for example port markets, not as much product has been built. With markets that can keep expanding into the suburbs, more and more concrete tilt warehousing has been built. Unfortunately the small-medium bay market has been left out despite massive persisting demand for small-medium bay warehouses. Vacancy for small-medium bay has actually decreased in most markets despite overall vacancy increasing. Lease rates for this mid range warehousing have also increased along with user sale prices.

As vacancy for small-medium bay remains historically low, users buy land and build because why buy an existing warehouse for $180 per square foot when you can build exactly what you need for $200-300 per square foot?

While some markets have increased vacancy, the vast majority of that vacancy is with big bay. The Tucson industrial market as a whole remains under-built and under-supplied. April’s CPI and PPI both rose for the second straight month. Currently, 3.5% CPI is above the fed’s target and the markets aren’t pricing in the rate cuts that were expected over the past 6 months. The ten year treasury ended 2023 below 4% and after the last CPI report, the ten year is now above 4.5%. Expect investment sales volumes to remain similar to those of 2023. Here’s the good news, with inflation on the rise again, we can expect the Tucson industrial market to remain strong and lease rates to continue to increase. 2024 could be the year where we see more industrial buildings get demolished, than delivered. Meanwhile, demand remains strong throughout the industrial market. The sticky part of inflation for Tucson is with construction. Many developers have put their plans to build on hold, not because of interest rates or lack of tenant demand, but mostly due to the rise in construction costs. Last month a Tucson residential subcontractor who does lots of work for the national homebuilders told me that they just had their biggest month in terms of new unit contracts, almost doubling their March 2023 volume. The subs are still busy and despite industrial construction slowing, construction costs remain elevated mostly due to the increase in residential construction and lack of skilled trades labor. With most recent projects, I’ve seen construction costs increase for smaller warehouses (30,000 SF and below) and costs come down just a little bit with bigger bay, concrete tilt construction. While materials have come down in pricing, labor costs continue to rise.

Former manufacturing/fabrication building with a fenced yard for outdoor storage along with 1,200 amp 480V service now available. 4261 S Country Club • 1 mile to I-10 • 3 phase power • 1,200 amp 480V power • Grade loading • 12’x15’ roll up door • 10 roll up doors • 12 offices • CI-2 – County heavy industrial zoning Listed by Max Fisher, BRD Realty Click below to download the PDF brochure

Max Fisher, BRD Realty, Sam Devouris & David Kimball, NAI Capital represented Piteau, a subsidiary of Tetratech (currently a 10B+ market cap) in the leasing of 13,000 SF at 7051 N Camino Martin. Formerly Bedroxx Bowling, Larsen Baker converted the building to four industrial bays. Piteau leased the Northeast bay. This lease is a testament to the strong industrial market, pushing lease rates north of $1.00 NNN. As vacancy continues to decline and lease rates increase, construction should pick up 2024-2025. The former Bedroxx bowling alley conversion is also an Opportunity Zone project. Isaac Figueroa and Elaina Elliott represented the Landlord, Larsen Baker.

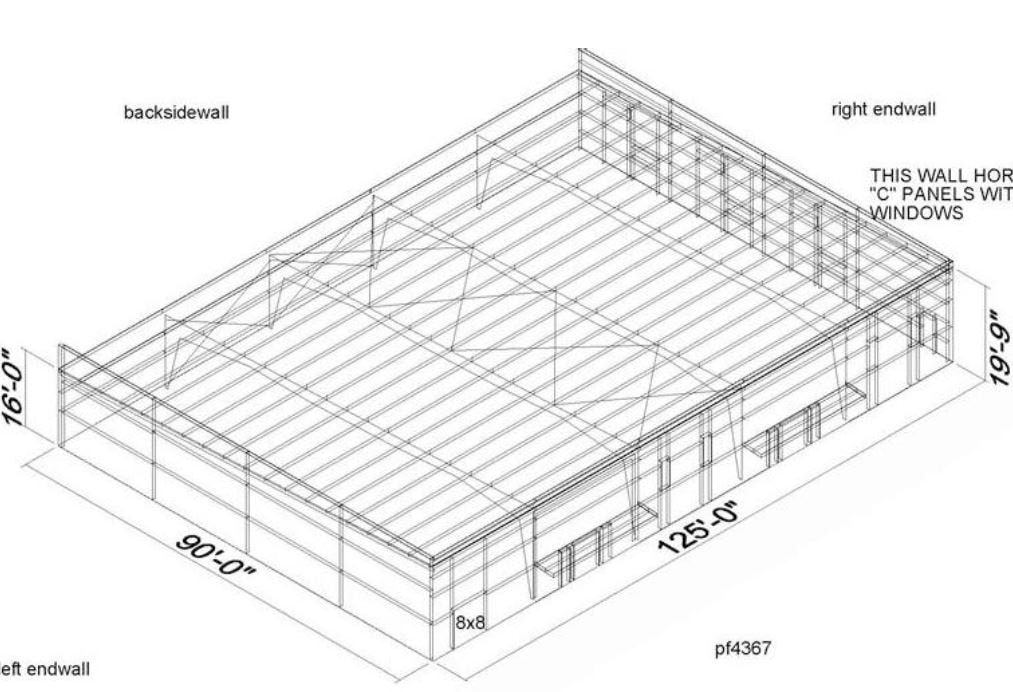

Sixteen years ago, in 2008, the industrial market was heavily dependent on the housing market. Building materials suppliers, contractors, distributors and manufacturers leased warehouses and industrial outdoor storage. Today the demand is much more diverse and robust. Demand has entered the market from; on-shoring, e-commerce, last mile distribution, cannabis, semi-conductor manufacturing, gigafactories, and quasi-retail uses like pickle ball, gyms and breweries. And that’s just to name a few. With this robust demand, the ancillary businesses follow. The chip manufacturer needs air filters so now an air filter supplier leases a warehouse. Amazon builds a new distribution center so now their fleet repair mechanic needs to add a bigger location absorbing 5 acres. Over the past ten years, more and more consumers started buying goods online. And then covid hit, everyone started buying goods from their phone and this put the industrial market on steroids. And then record low interest rates hit along with substantial increases in the money supply which led to more development and more consumer demand. In addition to shifts from the consumer leading to more demand for warehousing, infill industrial started to be demolished. As high as demand is for infill class b industrial, it is typically not the highest and best use, especially as housing demand has outpaced supply. If a developer wants to build a mid rise with retail on the bottom and multi-family above, a class b industrial site at $100 per square foot makes sense to buy, re-zone and build vertical on. With inflation rising, construction costs skyrocketed, outpacing lease rate growth. Then developers started to sit on the sidelines, struggling to pencil out high construction costs, rising interest rates and less financing options as banks hit a bump in the road. It really has been the perfect storm for industrial as demand for existing industrial is stronger than ever and existing warehouses get demolished faster than ever. For more commercial real estate insights, visit industrialtucson.com The summer of 2023 felt like 2018, activity was slower and less transactions were closing. I attribute the lack of transactions to increased interest rates, stubbornly high construction costs, and less confidence from tenants and buyers. Despite a sluggish summer, vacancy rates remain historically low. Vacancy in spaces less than 30,000 SF is the lowest and most of the time, a tenant or buyer is not able to lease or buy the space that they are looking for. Q4 has been incredibly strong, similar to 2021-2022 levels of activity and we feel a strong wave of demand entering the market. We expect vacancy to remain at record lows (sub 3%) during 2024 despite some aspects of the macro economy slowing. With major companies breaking ground on projects in Tucson like America Battery Manufacturing and Becton Dickinson, we expect more ancillary businesses to expand and/or move into the Tucson market, absorbing more space. While there is some speculative construction, there is not enough, especially for bays less than 50,000 SF. When we look at the Tucson vacancy rate, the majority of vacancy is with bays larger than 100,000 SF and all it takes is a few tenants to fill those vacancies and we will reach a vacancy rate less than 2%, possibly less than 1%. 2024 construction will occur mostly in the Airport and Vail market as those markets have available land and increased growth from both residential and industrial construction. The Northwest and Marana market will continue to see high lease rates, especially in flex markets. There is a need for more industrial land in the Marana market and as ag land gets re-zoned, we may see more industrial opportunities. There have only been a handful of speculative projects with bays less than 20,000 SF and they have all been successful despite construction delays, rising construction pricing, rising interest rates and persistent labor shortages. Right now we aren’t seeing any beginning stage flex projects being built, mostly due to construction pricing and labor shortages. We expected interest rates to pose a bigger threat but the cost to build is the biggest challenge in Tucson. There is money out there ready to build but it is tough to make the numbers pencil out with all time high construction costs and wage inflation. Lease rates have increased substantially over the past few years, even passing the $1.00 NNN mark but they will need to increase even more. I’m seeing demand for flex space in every part of the market and think the key to a successful speculative flex project is to have a retail component to get lease rates north of $1.60 NNN. I expect user building prices to remain strong and even increase during 2024 as available buildings continues to remain low while demand remains strong. I think $100+ per square foot for user buildings is here to stay and buildings with industrial outdoor storage commanding prices north of $120 per square foot. If I were to build the perfect user building in 2024 it would be a pre-engineering metal building around 10,000-20,000 SF on at least an acre with minimal office. There are plenty of tenants and buyers out there looking for a 10,000-20,000 SF stand alone building with close to nothing available.

We expect 2024 investment sales to remain low as investors can’t make 2021 prices pencil with 2024 interest rates. In addition to rising interest rates, banks are tightening their lending. The 2024 reality is that banks will have less to lend out and they are much more conservative. Access to debt will also create headwinds for construction. 2024 will continue to be a K shaped recovery both in the economy and real estate. Some aspects of real estate are feeling pain, like office and multi-family, while others are stronger than ever, like flex. We have seen more businesses file for bankruptcy or get locked out but the spaces backfill quickly and most vacancies are appearing in class c product. The businesses that we have seen struggle are businesses that have struggled from lack of skilled labor, access to materials or struggles to raise pricing. The reality of this new economy is that everything is more expensive and businesses need to raise their pricing or they are going to go out of business. Some of Tucson’s economic tailwinds that will continue to push rents up are; mining, on-shoring, distribution, and residential and industrial construction. As these four catalysts have a bright 3-5 year future, we expect flex, IOS and industrial vacancy to remain low while lease rates increase. Meanwhile, three re-development projects are set to demolish around 200,000 SF+ of existing class b, flex buildings. We expect continued strong demand while existing supply is set to be demolished which will push lease rates higher. Less supply, more demand, and higher pricing will be the theme for 2024. Single tenant building with heavy 480V power, 100% air conditioning and dock and grade loading. Located near the Airport, I-19, and I-10 offers convenient access and close proximity to Tucson’s major employers such as Raytheon, Modular Mining, Universal Avionics, and many others. This building lends itself to many subtypes of industrial (flex, distribution, R&D, manufacturing, and warehousing) with a sprinkler system, 18’ clear height, I-1 zoning, and a mostly warehouse floorplan. Click below to download the brochure

|

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

||||||||||||||||||||||

RSS Feed

RSS Feed