|

The fed is aggressively hiking rates, residential rents are starting to drop, and residential sales are slowing. Sellers are losing leverage slowly. Pulte just cancelled $800,000,000 in land acquisitions and lost $24,000,000 in earnest money deposits, but it’s still difficult to find a rental or a decent home that isn’t a new build.

Industrial vacancy is at an all time low, construction is at an all time high. If you’re an industrial tenant or buyer, good luck finding a building or land. Price per square foot for industrial has come close to doubling just within 2 years. Industrial rents are still increasing but at a slower pace compared to 2021. Available entitled industrial land is sparce. Ag land in Marana is being re-zoned to industrial. Amazon has put most of real estate expansions on hold while the brand new 200,000SF+ warehouse at Ina and Silverbell is still TBD. The stock market is starting to ripple into the real estate market with Meta announcing 11,000 layoffs and a pull out of the largest office lease in Austin. Construction costs are continuing to increase despite raw materials dropping. We can most likely attribute increased costs to the increase in trade wages and fuel/energy. Wage inflation typically lags. Supply chain disruptions seem to be evening out overall. Jerome Powell’s last speech didn’t indicate any slowing of rate hikes in the near future. Rate hikes are freezing capital markets and we can expect cap rates to adjust upwards. October’s inflation rate was announced this morning at 7.7%. This is great news as inflation dropped .5% month over month. Maybe Powell will pivot in 2023. This good news has the Nasdaq up 5.79% so far today. Office seems to be slow and lame, especially Class B, C and non-medical space. In June, a client sold a 7 unit office complex for $70 per square foot and traded into an industrial/flex park for $80 foot. The same client converted an old shopping center into small bay warehouses and now there’s only one vacancy at this former shopping center. The tenants that leased the warehouse conversions are gyms, contractors, Ecommerce businesses, and an after market auto related business. Retail is a mixed bag with big box looking lame while PADs, drive throughs and food related property is going strong. 9 months ago developers would get 10 separate term sheets from lenders, today they’re getting 3 and the terms are much different. With rougher debt terms, debt is becoming tougher to justify without cap rates moving much. I get at least one call per month asking for any distressed asset opportunities. They don’t exist right now. One global economic factor that gets little attention, should be getting 100x as much attention. The energy crisis in Europe. With Nordstream flows shut, Europe is having to import natural gas via ports from the US and the Middle East, instead of pipelines, which is incredibly costly. Inflation is significantly higher in Europe and isn’t showing signs of slowing. If the US has to import more and more gas and oil to Europe, this will affect US energy costs. Most people don’t know that TEP is mostly run on natural gas, along with many other utility providers. US Natural Gas prices are up 280% since August 2019. Could the global energy markets be dependent on a cold or warm European winter? How will the energy markets affect inflation? How will inflation affect the Fed? Do you know what the next year holds? Who the hell knows. I wish you all, happy holidays and a prosperous Q4 and 2023 : ) -Max Fisher, BRD Realty [email protected] *In the former article, Dr Horton was mentioned. That was a mistake, Pulte's earnings call referenced the $800,000,000 in cancelled land acquisitions.*

0 Comments

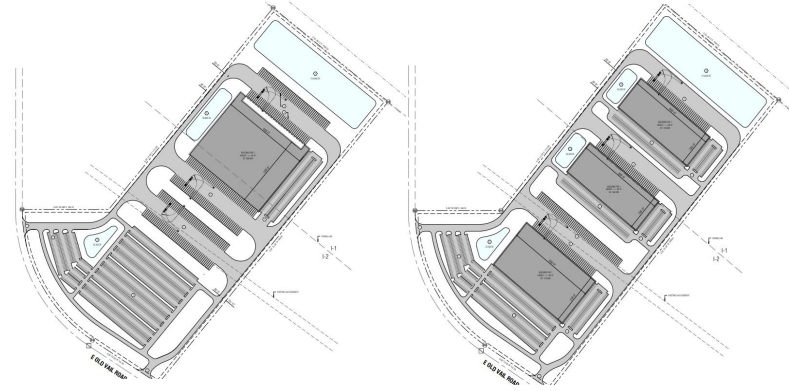

• Neighboring companies: Raytheon, Target.com, Amazon, Hudbay, University of Arizona Tech Parks, TuSimple, IBM, La Costena Manufacturing, Port of Tucson, AirLiquide, and United Healthcare • Preliminary site plans and renderings in hand • Less than .5 mile from I-10 • Survey and Phase One Environmental in hand • City of Tucson Industrial zoning • Zoned for cannabis cultivation • Flat terrain • Electric, gas, water, and sewer at the lot line • Frontage on Old Vail Road Vail is a quickly growing industrial and tech market with quick access to I-10, I-19 and the new announcement of the Sonoran Corridor which connects I-19 to Rita Road at I-10, the same exit for Sunbelt Industrial. TuSimple recently built proving grounds and an engineering campus less than a half mile from Sunbelt Industrial and the Target.com Distribution Center is less than a half mile as well. Sunbelt Industrial is surrounded by UA Tech Parks, IBM, Raytheon, Target Distribution, TuSimple, Amazon, the Port of Tucson, Becton Dickson, Hudbay, Tetakwai, and two new cannabis cultivators. Electric, water, sewer, gas and telecommunications are at the lot line, a survey and phase 1 are in hand, and the parcel is already zoned I-1 and I-2 which makes this parcel shovel ready for distributors, manufacturers and cannabis cultivators. This is a prime shovel ready site for mid-large scale industrial users in the Southwest region. Contact Max Fisher for more information. [email protected] 520-465-9989 Click below to download the brochure

|

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

||||||

RSS Feed

RSS Feed