|

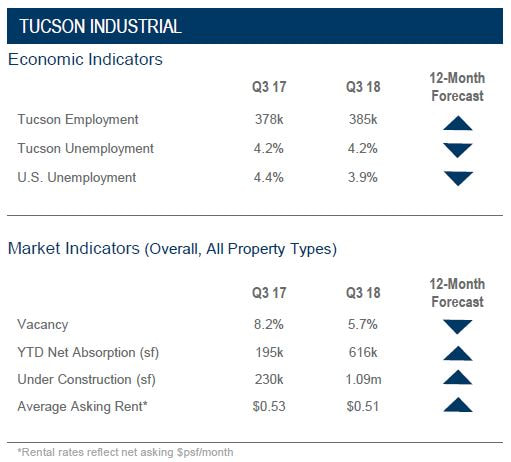

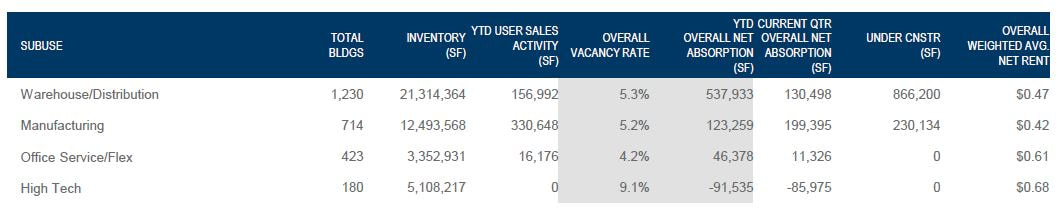

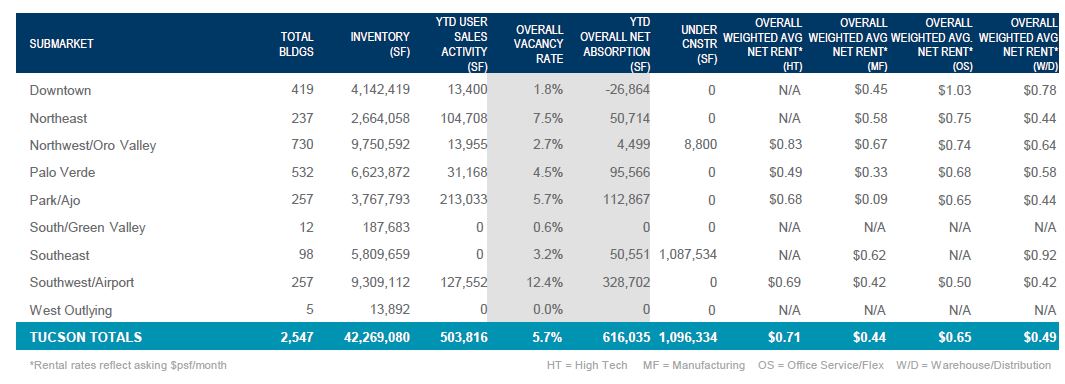

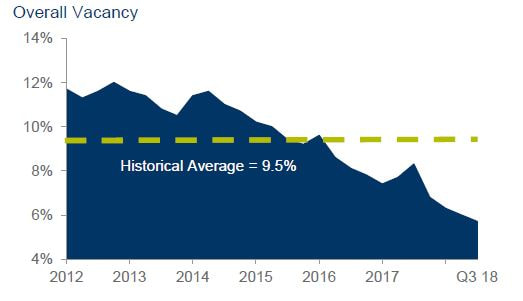

Economy Employment in Metro Tucson has continued to improve, ending the third quarter of 2018 with an increase in jobs of 6,700 from a total of 378,500 in the third quarter of 2017. The Tucson economy will continue this trend of steady growth due to the new industries and large employers that have been attracted to the area. Market Overview The industrial market for the third quarter 2018 continued its strong momentum. Overall vacancy has dropped to 5.7%, well below the historical average of 9.5% and the highest occupancy experienced since 2007. Vacancy is lowest in the office service/flex sector and highest for high-tech space. The majority of the vacancy is in larger spaces over 50,000 square feet (sf). Year-to-date absorption of 616,035 sf was driven by continued expansion in logistics, mining, building materials, and defense-related businesses. Building sales activity is strong with functional inventory selling quickly. Volume through the third quarter 2018 of $105 million well outpaced 2017’s full-year total of $67 million. Average sale prices per sf are up 12% over 2017, rising from $68 to $76 per sf. That being said, investment transactions have slowed due to a lack of sale inventory. Land sale activity is showing signs of life but remains low relative to pre-2007 levels. The general industrial inventory of existing properties suffers from a degree of functional obsolescence. Those projects with ample parking, loading, ceiling heights, and contemporary design will see the strongest absorption and appreciation in rents and pricing. Significant projects under construction include a 230,134 sf cross-dock rail-served facility at Century Park and Amazon’s 857,400 sf distribution center scheduled for completion in Q2 2019. Outlook

Absorption will continue a strong and positive trend. Expect to see meaningful activity in larger blocks of space and buildings. The economic development pipeline is the strongest it has been in several years. Rents in spaces under 10,000 sf will continue to rise with the most significant rent increases in lease space under 3,000 sf. Speculative construction will return to the market. Land sale activity will continue to improve as confident business owners choose to control their costs when faced with rising lease rates.

0 Comments

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed