|

In most markets throughout the US, industrial vacancy is on the rise but it’s important to understand which part of the market vacancy is rising in. Over the past 5 years during this development boom, the vast majority of industrial was built in the large bay markets, 100,000 SF+ bays. In markets that don’t have excess land to build, for example port markets, not as much product has been built. With markets that can keep expanding into the suburbs, more and more concrete tilt warehousing has been built. Unfortunately the small-medium bay market has been left out despite massive persisting demand for small-medium bay warehouses. Vacancy for small-medium bay has actually decreased in most markets despite overall vacancy increasing. Lease rates for this mid range warehousing have also increased along with user sale prices.

As vacancy for small-medium bay remains historically low, users buy land and build because why buy an existing warehouse for $180 per square foot when you can build exactly what you need for $200-300 per square foot?

While some markets have increased vacancy, the vast majority of that vacancy is with big bay. The Tucson industrial market as a whole remains under-built and under-supplied.

0 Comments

April’s CPI and PPI both rose for the second straight month. Currently, 3.5% CPI is above the fed’s target and the markets aren’t pricing in the rate cuts that were expected over the past 6 months. The ten year treasury ended 2023 below 4% and after the last CPI report, the ten year is now above 4.5%. Expect investment sales volumes to remain similar to those of 2023. Here’s the good news, with inflation on the rise again, we can expect the Tucson industrial market to remain strong and lease rates to continue to increase. 2024 could be the year where we see more industrial buildings get demolished, than delivered. Meanwhile, demand remains strong throughout the industrial market. The sticky part of inflation for Tucson is with construction. Many developers have put their plans to build on hold, not because of interest rates or lack of tenant demand, but mostly due to the rise in construction costs. Last month a Tucson residential subcontractor who does lots of work for the national homebuilders told me that they just had their biggest month in terms of new unit contracts, almost doubling their March 2023 volume. The subs are still busy and despite industrial construction slowing, construction costs remain elevated mostly due to the increase in residential construction and lack of skilled trades labor. With most recent projects, I’ve seen construction costs increase for smaller warehouses (30,000 SF and below) and costs come down just a little bit with bigger bay, concrete tilt construction. While materials have come down in pricing, labor costs continue to rise.

Former manufacturing/fabrication building with a fenced yard for outdoor storage along with 1,200 amp 480V service now available. 4261 S Country Club • 1 mile to I-10 • 3 phase power • 1,200 amp 480V power • Grade loading • 12’x15’ roll up door • 10 roll up doors • 12 offices • CI-2 – County heavy industrial zoning Listed by Max Fisher, BRD Realty Click below to download the PDF brochure

Max Fisher, BRD Realty, Sam Devouris & David Kimball, NAI Capital represented Piteau, a subsidiary of Tetratech (currently a 10B+ market cap) in the leasing of 13,000 SF at 7051 N Camino Martin. Formerly Bedroxx Bowling, Larsen Baker converted the building to four industrial bays. Piteau leased the Northeast bay. This lease is a testament to the strong industrial market, pushing lease rates north of $1.00 NNN. As vacancy continues to decline and lease rates increase, construction should pick up 2024-2025. The former Bedroxx bowling alley conversion is also an Opportunity Zone project. Isaac Figueroa and Elaina Elliott represented the Landlord, Larsen Baker.

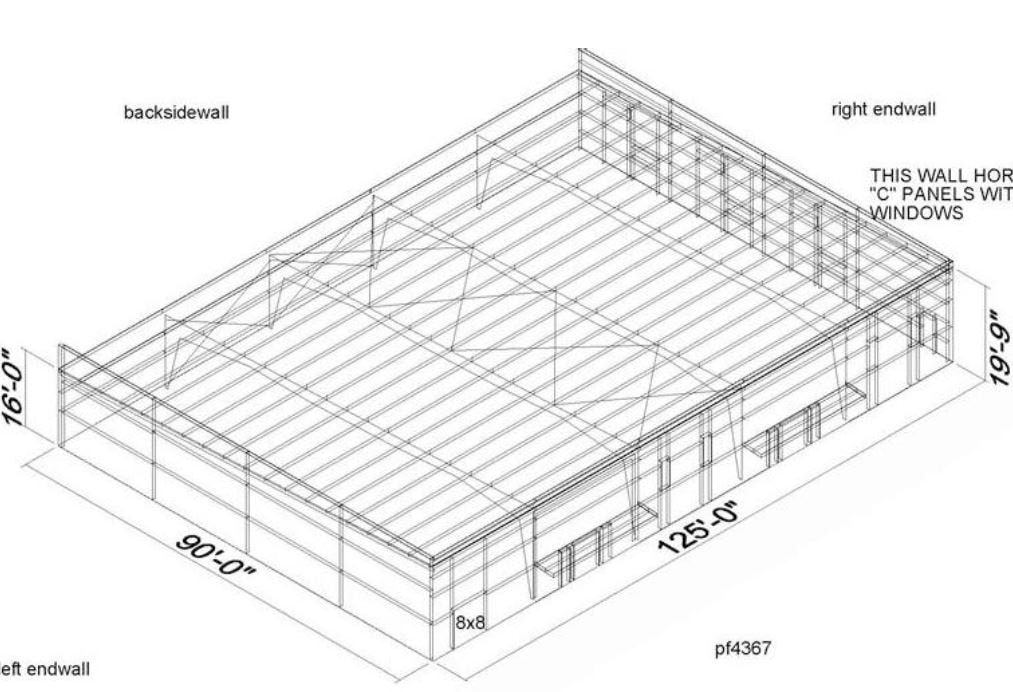

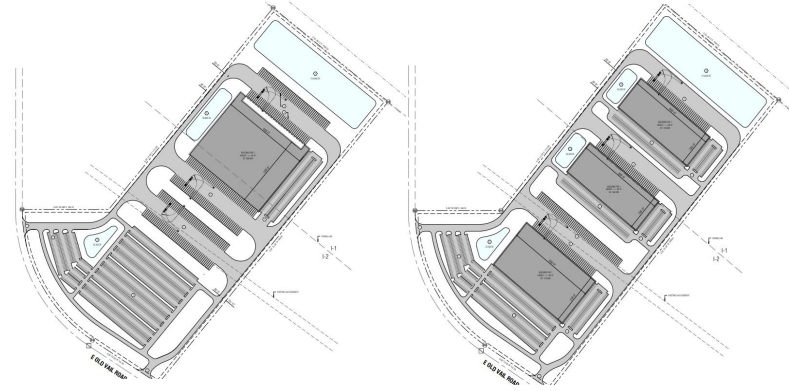

Sixteen years ago, in 2008, the industrial market was heavily dependent on the housing market. Building materials suppliers, contractors, distributors and manufacturers leased warehouses and industrial outdoor storage. Today the demand is much more diverse and robust. Demand has entered the market from; on-shoring, e-commerce, last mile distribution, cannabis, semi-conductor manufacturing, gigafactories, and quasi-retail uses like pickle ball, gyms and breweries. And that’s just to name a few. With this robust demand, the ancillary businesses follow. The chip manufacturer needs air filters so now an air filter supplier leases a warehouse. Amazon builds a new distribution center so now their fleet repair mechanic needs to add a bigger location absorbing 5 acres. Over the past ten years, more and more consumers started buying goods online. And then covid hit, everyone started buying goods from their phone and this put the industrial market on steroids. And then record low interest rates hit along with substantial increases in the money supply which led to more development and more consumer demand. In addition to shifts from the consumer leading to more demand for warehousing, infill industrial started to be demolished. As high as demand is for infill class b industrial, it is typically not the highest and best use, especially as housing demand has outpaced supply. If a developer wants to build a mid rise with retail on the bottom and multi-family above, a class b industrial site at $100 per square foot makes sense to buy, re-zone and build vertical on. With inflation rising, construction costs skyrocketed, outpacing lease rate growth. Then developers started to sit on the sidelines, struggling to pencil out high construction costs, rising interest rates and less financing options as banks hit a bump in the road. It really has been the perfect storm for industrial as demand for existing industrial is stronger than ever and existing warehouses get demolished faster than ever. For more commercial real estate insights, visit industrialtucson.com The summer of 2023 felt like 2018, activity was slower and less transactions were closing. I attribute the lack of transactions to increased interest rates, stubbornly high construction costs, and less confidence from tenants and buyers. Despite a sluggish summer, vacancy rates remain historically low. Vacancy in spaces less than 30,000 SF is the lowest and most of the time, a tenant or buyer is not able to lease or buy the space that they are looking for. Q4 has been incredibly strong, similar to 2021-2022 levels of activity and we feel a strong wave of demand entering the market. We expect vacancy to remain at record lows (sub 3%) during 2024 despite some aspects of the macro economy slowing. With major companies breaking ground on projects in Tucson like America Battery Manufacturing and Becton Dickinson, we expect more ancillary businesses to expand and/or move into the Tucson market, absorbing more space. While there is some speculative construction, there is not enough, especially for bays less than 50,000 SF. When we look at the Tucson vacancy rate, the majority of vacancy is with bays larger than 100,000 SF and all it takes is a few tenants to fill those vacancies and we will reach a vacancy rate less than 2%, possibly less than 1%. 2024 construction will occur mostly in the Airport and Vail market as those markets have available land and increased growth from both residential and industrial construction. The Northwest and Marana market will continue to see high lease rates, especially in flex markets. There is a need for more industrial land in the Marana market and as ag land gets re-zoned, we may see more industrial opportunities. There have only been a handful of speculative projects with bays less than 20,000 SF and they have all been successful despite construction delays, rising construction pricing, rising interest rates and persistent labor shortages. Right now we aren’t seeing any beginning stage flex projects being built, mostly due to construction pricing and labor shortages. We expected interest rates to pose a bigger threat but the cost to build is the biggest challenge in Tucson. There is money out there ready to build but it is tough to make the numbers pencil out with all time high construction costs and wage inflation. Lease rates have increased substantially over the past few years, even passing the $1.00 NNN mark but they will need to increase even more. I’m seeing demand for flex space in every part of the market and think the key to a successful speculative flex project is to have a retail component to get lease rates north of $1.60 NNN. I expect user building prices to remain strong and even increase during 2024 as available buildings continues to remain low while demand remains strong. I think $100+ per square foot for user buildings is here to stay and buildings with industrial outdoor storage commanding prices north of $120 per square foot. If I were to build the perfect user building in 2024 it would be a pre-engineering metal building around 10,000-20,000 SF on at least an acre with minimal office. There are plenty of tenants and buyers out there looking for a 10,000-20,000 SF stand alone building with close to nothing available.

We expect 2024 investment sales to remain low as investors can’t make 2021 prices pencil with 2024 interest rates. In addition to rising interest rates, banks are tightening their lending. The 2024 reality is that banks will have less to lend out and they are much more conservative. Access to debt will also create headwinds for construction. 2024 will continue to be a K shaped recovery both in the economy and real estate. Some aspects of real estate are feeling pain, like office and multi-family, while others are stronger than ever, like flex. We have seen more businesses file for bankruptcy or get locked out but the spaces backfill quickly and most vacancies are appearing in class c product. The businesses that we have seen struggle are businesses that have struggled from lack of skilled labor, access to materials or struggles to raise pricing. The reality of this new economy is that everything is more expensive and businesses need to raise their pricing or they are going to go out of business. Some of Tucson’s economic tailwinds that will continue to push rents up are; mining, on-shoring, distribution, and residential and industrial construction. As these four catalysts have a bright 3-5 year future, we expect flex, IOS and industrial vacancy to remain low while lease rates increase. Meanwhile, three re-development projects are set to demolish around 200,000 SF+ of existing class b, flex buildings. We expect continued strong demand while existing supply is set to be demolished which will push lease rates higher. Less supply, more demand, and higher pricing will be the theme for 2024. Single tenant building with heavy 480V power, 100% air conditioning and dock and grade loading. Located near the Airport, I-19, and I-10 offers convenient access and close proximity to Tucson’s major employers such as Raytheon, Modular Mining, Universal Avionics, and many others. This building lends itself to many subtypes of industrial (flex, distribution, R&D, manufacturing, and warehousing) with a sprinkler system, 18’ clear height, I-1 zoning, and a mostly warehouse floorplan. Click below to download the brochure

One year ago, industrial land was selling to developers like hotcakes. Today those developers are struggling to make development pencil out. While lease rates have increased and vacancies are at an all-time low, the cost of building has also increased. Some developers have paused speculative projects. This stagnant supply and strong demand dynamic are creating challenges for tenants, brokers, and developers. Transaction volumes are considerably less than what they were one year ago as tenants and buyers can’t find available space and interest rates have grid-locked the investment side of the market.

A separate but related concern throughout the market is the increase in NNN expenses. Insurance rates are increasing across the board, taxes are increasing, and maintenance costs are increasing. Persistent labor challenges are also driving the costs of.............. Click below to read the full Trend Report trendreportaz.com/wp-content/uploads/2023/04/TRENDreportMay2023.pdf 3740 E 43rd Pl sold for $1,090,000 Max Fisher, BRD Realty handled this transaction Washington Inaugural Properties LLC purchased the 10,000 SF warehouse from RICMICNIK LLC Pascua Yaqui Tribe purchased a 3,680 SF trucking terminal on 2.95 acres from CDR Leasing LLC for $750,000 Max Fisher, BRD Realty represented the seller. Veronica Robles, Homesmart Advantage Group represented the buyer 1615 W Grant, a 7,200 SF warehouse was leased to Better Box LLC. Max Fisher, BRD Realty handled this transaction. The landlord was Rodgers-Hoge Partners.

2,130 SF of warehouse at 8101 E Research Court was leased by Tony's Tuning and Specialties LLC. Max Fisher, BRD Realty handled this transaction. Research Investors LLC was the landlord. 1,000 SF of warehouse at 2112 N Dragoon Suite 19 was leased to Seven Eleven Customs. Max Fisher, BRD Realty handled this transaction. the landlord was Rich Rodgers South Inc. 1,700 SF of warehouse at 50 W Fort Lowell was leased to Zachary Jones. Max Fisher, BRD Realty handled this transaction. the landlord was R Legacy Irrevocable Trust. The fed is aggressively hiking rates, residential rents are starting to drop, and residential sales are slowing. Sellers are losing leverage slowly. Pulte just cancelled $800,000,000 in land acquisitions and lost $24,000,000 in earnest money deposits, but it’s still difficult to find a rental or a decent home that isn’t a new build.

Industrial vacancy is at an all time low, construction is at an all time high. If you’re an industrial tenant or buyer, good luck finding a building or land. Price per square foot for industrial has come close to doubling just within 2 years. Industrial rents are still increasing but at a slower pace compared to 2021. Available entitled industrial land is sparce. Ag land in Marana is being re-zoned to industrial. Amazon has put most of real estate expansions on hold while the brand new 200,000SF+ warehouse at Ina and Silverbell is still TBD. The stock market is starting to ripple into the real estate market with Meta announcing 11,000 layoffs and a pull out of the largest office lease in Austin. Construction costs are continuing to increase despite raw materials dropping. We can most likely attribute increased costs to the increase in trade wages and fuel/energy. Wage inflation typically lags. Supply chain disruptions seem to be evening out overall. Jerome Powell’s last speech didn’t indicate any slowing of rate hikes in the near future. Rate hikes are freezing capital markets and we can expect cap rates to adjust upwards. October’s inflation rate was announced this morning at 7.7%. This is great news as inflation dropped .5% month over month. Maybe Powell will pivot in 2023. This good news has the Nasdaq up 5.79% so far today. Office seems to be slow and lame, especially Class B, C and non-medical space. In June, a client sold a 7 unit office complex for $70 per square foot and traded into an industrial/flex park for $80 foot. The same client converted an old shopping center into small bay warehouses and now there’s only one vacancy at this former shopping center. The tenants that leased the warehouse conversions are gyms, contractors, Ecommerce businesses, and an after market auto related business. Retail is a mixed bag with big box looking lame while PADs, drive throughs and food related property is going strong. 9 months ago developers would get 10 separate term sheets from lenders, today they’re getting 3 and the terms are much different. With rougher debt terms, debt is becoming tougher to justify without cap rates moving much. I get at least one call per month asking for any distressed asset opportunities. They don’t exist right now. One global economic factor that gets little attention, should be getting 100x as much attention. The energy crisis in Europe. With Nordstream flows shut, Europe is having to import natural gas via ports from the US and the Middle East, instead of pipelines, which is incredibly costly. Inflation is significantly higher in Europe and isn’t showing signs of slowing. If the US has to import more and more gas and oil to Europe, this will affect US energy costs. Most people don’t know that TEP is mostly run on natural gas, along with many other utility providers. US Natural Gas prices are up 280% since August 2019. Could the global energy markets be dependent on a cold or warm European winter? How will the energy markets affect inflation? How will inflation affect the Fed? Do you know what the next year holds? Who the hell knows. I wish you all, happy holidays and a prosperous Q4 and 2023 : ) -Max Fisher, BRD Realty max@torchprops.com *In the former article, Dr Horton was mentioned. That was a mistake, Pulte's earnings call referenced the $800,000,000 in cancelled land acquisitions.* |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

||||||||||||||||

RSS Feed

RSS Feed