|

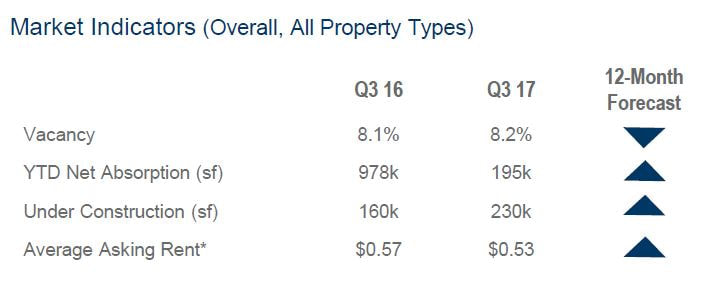

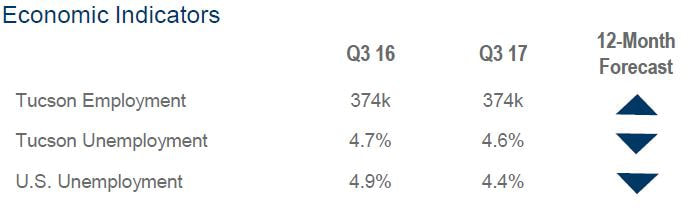

Up. Every sector of Tucson Commercial Real Estate seems to be improving at a steady pace. Retail, office, multi-family, and industrial inventory is starting to shrink, values are increasing, and development is starting to pick up for the first time in over a decade. For years the land market has been stagnant with very little land sales and barely a pulse. Now the entire market is seeing action. Why is the Tucson market suddenly picking up? New high quality job additions from Raytheon, Caterpillar, and other employers and injections of capital from investors. Tucson is starting to be known as an under valued city which is bringing in investors from California and other competitive markets, effectively driving values up and cap rates down. Economy The economic outlook remains positive nationally and in the Tucson region. The year-end 2017 U.S. real GDP forecast shows 2.2% growth year over year, with 2018 expected to be 2.4%. Natural disasters such as the recent hurricanes and fires are not the optimal way to maintain economic growth, however federal and insurance funding should boost economic activity throughout these impacted areas and beyond. The U.S. seasonally adjusted unemployment rate stands at 4.4%, with Arizona posting 5.0% statewide, and the Tucson metro area at 4.9%. Year-to-date 2017, Arizona ranks 13 out of 50 states for job growth.Over the same period, new home permits for Tucson are up 18.2% to 2,152, compared to 1,821 for the same period last year. Market Overview The industrial market in Tucson has largely arrived at an equilibrium in lease negotiations between Landlord and Tenants. Vacancy experienced a slight uptick in the past two consecutive quarters, but this is viewed as a natural ebb-and-flow as tenants move around our market, rather than an indication of trouble. It is estimated that a certain fixed percentage of the vacancy rate, possibly between 2-4%, can be considered “functionally obsolete”, and therefore results in a higher-than-actual vacancy rate.The other factor in vacancy is the lack of larger requirements, resulting in stagnant activity in the available spaces over 100,000 square feet (SF). There are currently 62 buildings in Tucson that are 100,000 SF or larger, totaling 11.6 million SF.There is an 11% vacancy rate (1.2 MSF available).That leaves the rest of the market of smaller buildings with a vacancy rate of 7.2%. Industrial sales remain brisk, with continued interest in investment as well as strong owner/user properties. Construction activity continues to center around build-to-suit for users, as opposed to speculative investment construction. This is due to the fact prevailing rental rates have not yet risen to a level that justifies the rents required for new construction, which are estimated in the $0.75/SF -$1.00/SF NNN in most cases. Outlook The near-term outlook for the Tucson Industrial market, absent some notable occurrence in our business community, continues to be more of the same, which includes a strong-and-stable occupancy rate, slowly rising rental rates and solid sales activity. However, in the event that the Rosemont Copper mine commences construction, or another large employer lands in Tucson and absorbs some of our larger long-term vacancies, the outlook will improve quickly given that there is very little functional vacancy remaining in the market. Most Recent Industrial Sale Comp. 3837 E 37th St, Warehouse and Contractor’s Yard. Sold to Arizona Pro-Landscape. Max Fisher, Cushman & Wakefield | PICOR handled this transaction. SF: 3,750 Acres: .31 Sold Price: $239,900 ($65 per SF) For more sales comps or upcoming listings contact Max Fisher, Industrial Real Estate Broker, 520-465-9989 Max Fisher specializes in the leasing and sale of industrial and business park properties, including flex/research and development, warehouse and distribution, and manufacturing space.

0 Comments

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed