|

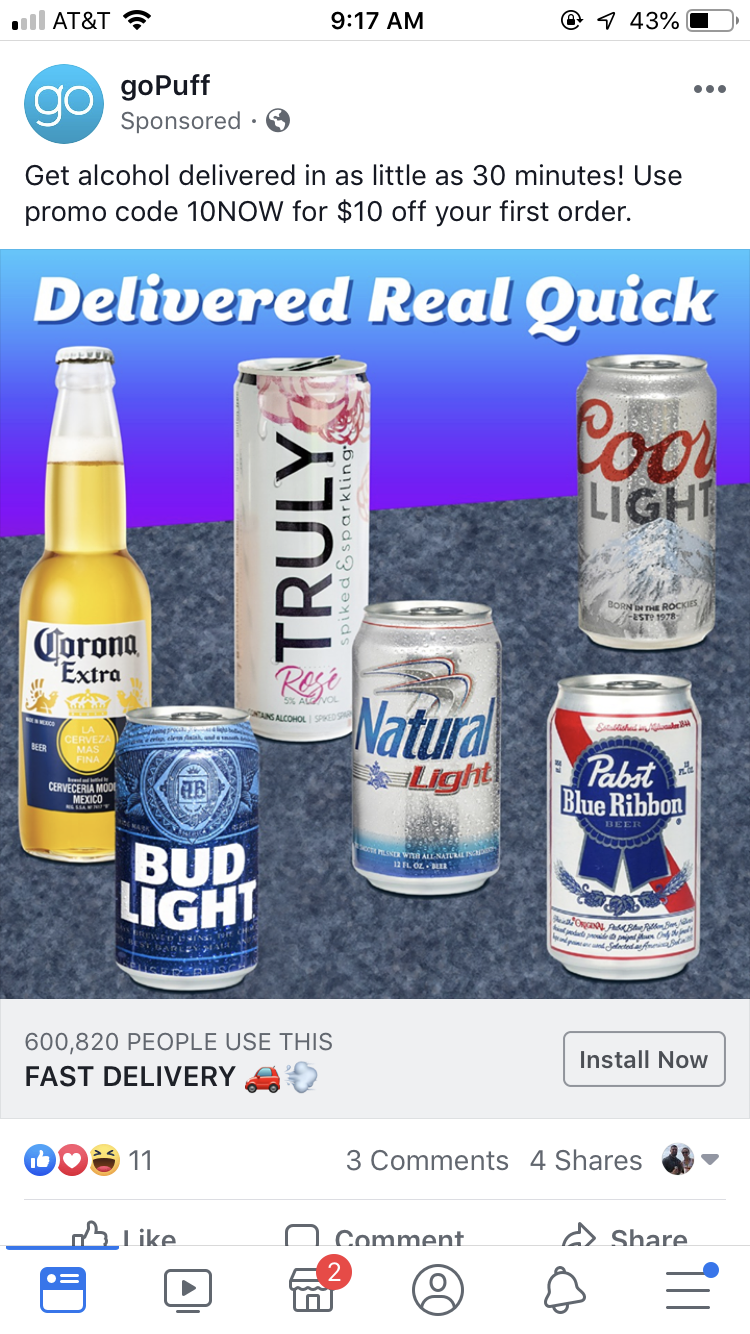

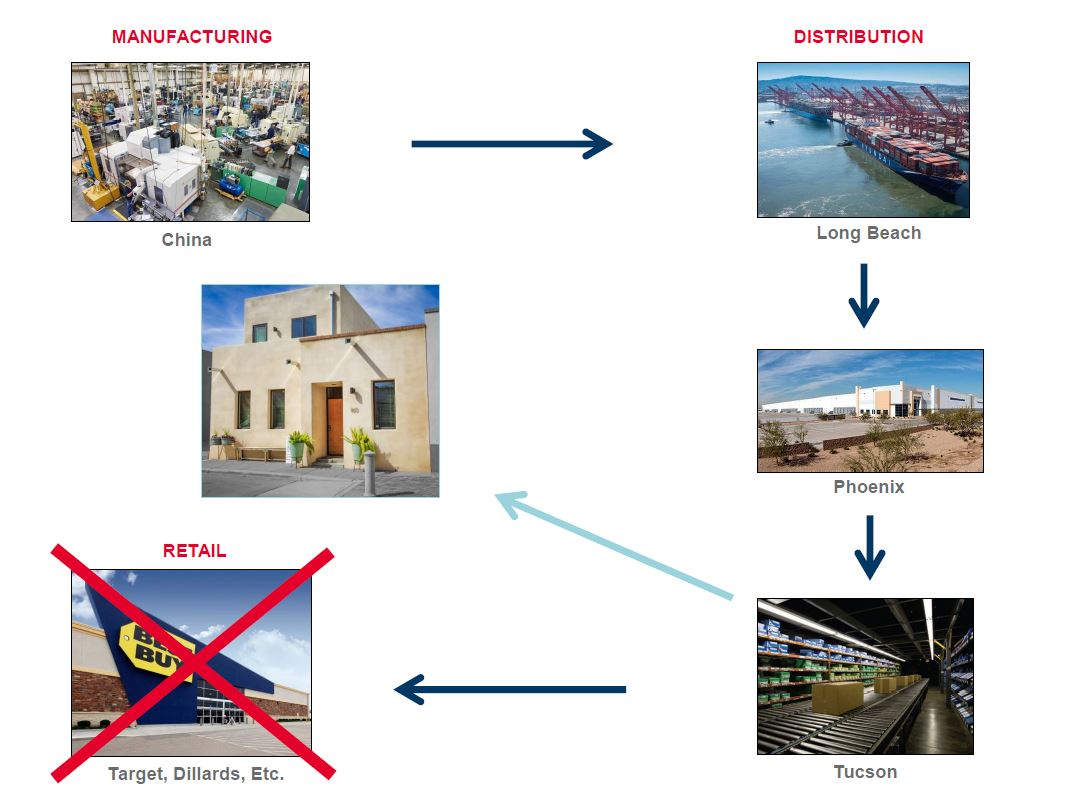

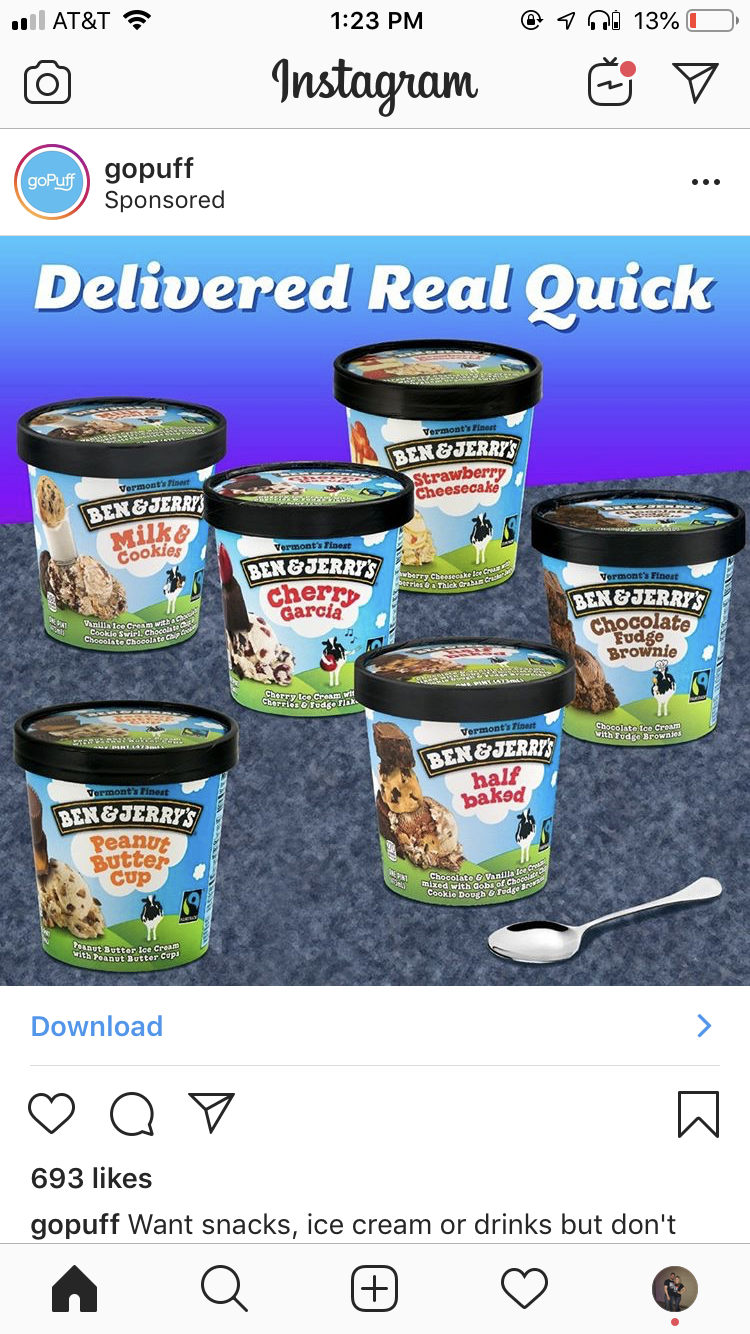

Recent closures of Target on Broadway, Office Depot on Broadway, Sears at Park Place, multiple Frys, multiple Walgreens, and many other retail businesses are creating worries for many Tucsonans. Is this increase in closures a sign of a declining economy? No, this is a massive shift in our real estate market that not many are talking about. Consumer purchasing is shifting quickly and instead of storing product at a retail store like Target, Ecommerce companies can ship directly from the warehouse. Now, for a lot of businesses there’s no need for retail exposure anymore because the consumer identifies the company/product on GoPuff, Amazon, Google, Yelp, etc as opposed to driving down the street. GoPuff recently leased 7,000+ SF of warehouse in the Eastside Research Loop Industrial Park for "Last Mile" distribution. Last Mile distribution means the product is ordered from your phone or computer and delivered directly to your door from a warehouse within your city. GoPuff delivers products such as ice cream, beer, wine, Advil, toilet paper, etc. Pretty much everything you can get at a Walgreens or CVS. The last mile distribution companies are leasing warehouses which are around 20-25% of the cost of a retail building, sometimes even less. Lower rent means cheaper prices which will create competition for retailers, effectively disrupting their business and bankrupting them (Sports Authority)……..is LA Fitness next? Barnes & Noble? Subway? Safeway? CVS?

This effectively creates more demand for industrial property/warehouses which means rates rise and industrial development will follow. Other cities such as LA, Phoenix, Atlanta,and many more have already experienced this. Tucson is just starting to feel the effects. Other markets are already experiencing autonomous deliveries straight to their door step, and product being delivered within 1 hour of ordering. My prediction is that the future of retail is food and entertainment but the future of industrial is steady and strong growth with autonomous last mile distribution leading the way. Rob Glaser and Max Fisher, Cushman & Wakefield | PICOR handled the most recent GoPuff transaction, 7,000 + SF.

1 Comment

5/14/2020 09:44:43 pm

This is a massive shift in our real estate market !

Reply

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed