|

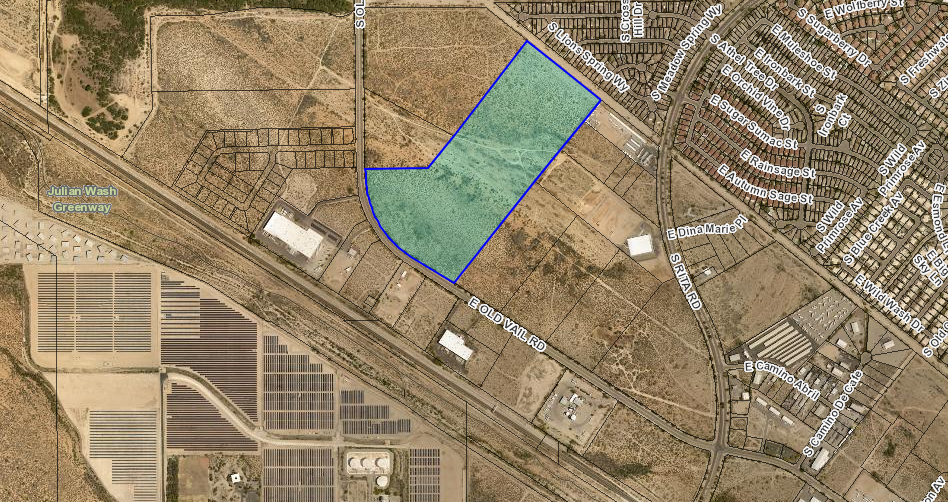

Since the recession, land has been sluggish as vacancy hovered between 7-12%. The market now has become so tight that now land is selling left and right. Vacant airport area land is now tough to find. Cranes are tilting walls for mid to large size distribution centers for users and speculative developers. Available industrial land is now drying up with the uptick in demand. Available existing inventory is at an all time low with vacancy below 5% and lease rates quickly rising. The Northwest market has the highest lease rates and the least amount of vacancy. Lease rates in the Palo Verde, Ajo and Airport market are quickly catching up to Northwest rates. The amount of available buildings for sale is at an all time low. It is definitely a seller’s market, even for functionally obsolescent buildings and buildings in need of repair. As the price per SF rises, spec buildings for sale are starting to be built. We can expect that spec buildings, mostly metal will be built as price per SF pushes towards $100 per SF. So what is causing this rush of demand? A combination of migration from California and dense cities, the Ecommerce rush, Cannabis legalization, stimulus, and the booming demand of building materials. When will supply catch up? Supply will begin to catch up with demand as lease rates continue to rise. Rising lease rates spur speculative development. Speculative developers have already proven that development makes sense in Tucson so now we are starting to see an increase in development activity, mostly in the distribution market. We can expect to see small bay developers start building as lease rates push North of $,80 NNN per SF. We can also expect to see large distribution centers enter the market as conventional retailers shift their models towards last mile distribution. Are we expecting a slow down? We are not expecting a slow down as long as long as migration from California and dense cities continues and Ecommerce demand continues to grow. these are the two main demand drivers right now. Eileen Lewis of Torch Properties/BRD Realty was recently featured in BOMA’s most recent article reporting on the US industrial market, read below Industrial Demand: A Market Revolution (boma.org) New listing: 60 acres of industrial zoned land priced below market. Near to U of A Tech Parks, TuSimple, Raytheon, Amazon, Target Distribution, and three new cannabis cultivation sites. Click below to download the brochure.

0 Comments

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

||||||

RSS Feed

RSS Feed