|

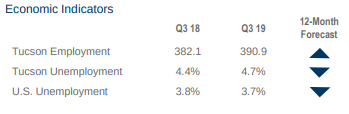

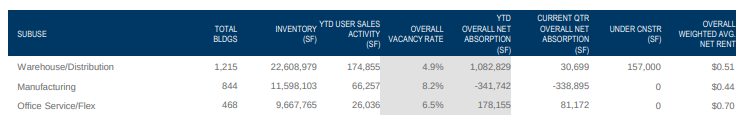

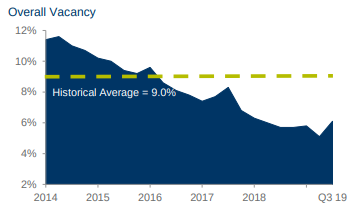

Outlook Several large companies remain interested in relocating in Tucson, which would further compress our vacancy if other market factors hold steady. Despite some national forecasts and early indicators of future headwinds, the Tucson industrial market shows no tangible signs of slowdown and should continue on its current pace into the new year. Above photos: Los Reales industrial land with proposed development plans for sale $6,450,000 Tucson Median household income is up 2.6% over the past year and US consumer spending growth is up 4.1%. Labor and materials costs continue to rise, effectively increasing development costs. Recent openings of Gunnison Project Copper Mine and South 32 Mine in Patagonia have spurred growth in southern Arizona mining and the businesses supporting the mining industry. Residential master-planned communities such as Lazy K, Rocking K, and Gladden Farms continue to advance, spurring job growth in the construction industry and absorption of industrial properties for contractors and construction supply distributors. Tucson’s population has grown 1.4% over the past year. California residents and companies are increasingly moving to Tucson as California costs of doing business and living continue to rise. US unemployment improved to 3.7% as Tucson’s slightly increased to 4.7% from a year ago. The Tucson industrial market remained stable through Q3 2019. While the overall market vacancy rose one percentage point from the second quarter to 6.1%, this change is impacted by several large back-office (call center) spaces that have recently come on the market which is included in the available space. Aside from call center availabilities, however, the industrial market remained tight and primarily a landlord/seller’s market. High absorption during the quarter is actually carry-over from late Q2 2019 and is primarily related to the Amazon distribution center coming online. In addition, the market vacancy is overstated by 90 basis points due to inclusion of 423,036 square feet (sf) of space in four buildings currently occupied, but available. Rents remained firm but relatively flat, with just enough vacancy in the market and a lack of new speculative construction to tamp-down what would otherwise contribute to accelerating rents during this strong market cycle. The divide between rents on existing space and what is needed for most new construction persists, which is holding back land sales and new speculative construction in the market. On the sale side, investor interest maintained velocity, with regional investors flocking to tertiary markets such as Tucson in search of cap rates exceeding those in the competitive, primary markets. Marketwide sales prices have averaged approximately $93 per for the last six quarters. Smaller user properties are also seeing robust purchase and sale activity. Recent announcements with the South 32 mine in Patagonia and Rosemont Copper are bringing increased activity to Tucson with companies such as Hexagon Mining and Caterpillar. There have also been recent openings of smaller scale copper mines in Cochise County that haven't received much, if any press. We expect to see this activity ramp up and soon we will see increased activity with mining sub-contractors and materials suppliers, especially in the Palo Verde to Vail sub markets. Aerospace, defense and mining manufacturing continue to lead the charge in Tucson manufacturing. The strongest sub-markets in Tucson are the Northwest and Downtown markets. As the downtown and northwest markets have around 3% vacancy we will watch as demand grows further North into Marana with new construction and further south towards the airport and Vail, effectively filling already vacant buildings to the South and East. Airport and Palo Verde area activity is much stronger than this time last year. Rates in the Palo Verde market have already jumped from $.50 MG to $.60 MG within one year. Tucson continued to experience strong employment, ending September at a 4.7% unemployment rate. Meanwhile, manufacturing, logistics, and construction employers struggle to find skilled manufacturing labor. There are also rumblings of medium to large industrial land transactions in Marana and near the Tucson airport.......more to come soon. Market Moves -Raytheon announced a merger with United Technologies which will be the largest defense merger in US history -Nikola Motors announced a new 400 acre manufacturing facility in Pinal County -Modular Mining expands autonomous mining research, development and manufacturing operations in Tucson -Lucid Motors announces new $700,000,000 manufacturing facility in Pinal County -Harsch Investment started construction on a 150,000 SF + speculative distribution facility near the Tucson Airport - University of Arizona Veterinarian College purchases a 40,000 SF facility in Oro Valley Recent significant industrial transactions completed by Max Fisher; Lease - 2005 N 13th Ave - 13,848 SF Sale - 6060 S Brosius - 59,500 SF Sale - 10900 N Stallard - 38,010 SF Lease - 1668 S Research Loop - 7,500 SF Sale - 2300 E Vistoso Commerce Loop - 12,000 SF Lease - 4151 E Tennessee - 7,500 SF Most recent manufacturing deals completed by Max Fisher; Thesuperchargerstore.com Arizona Heritage Cabinetry Steel Dor Paperwork Analysis Gorilla Splitters Nelson Precision Machining Boogeyman Customs Photonic Materials Delta Development Helico Solar HDPE Fusion Dynamic Manufacturing

0 Comments

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed