|

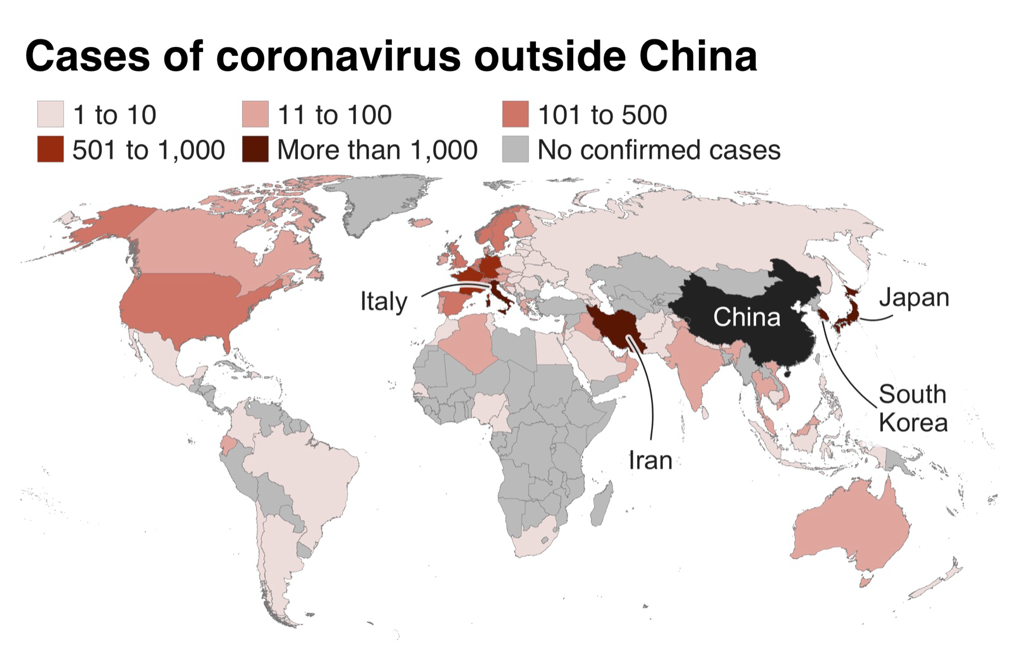

The stock market is down, the media is blasting coronavirus on every media platform, and we’re not sure how it will affect our local market. Short term I feel we will start to feel the effects within the next few weeks but the effects will be related to supply chain. Long term, I feel this will help the US as a whole, I’ll get to that in a bit..... China is the manufacturing powerhouse of the world which makes the US very reliant upon Chinese goods, especially commodities. I have already seen one tenant start to default on their lease due to the supply chain issue. Parts of China have manufacturing shut down and aren’t able to produce and ship their products to US companies which is going to hurt US companies. Home Depot is sold out of masks party because of high demand but mostly because China decided to turn their ships around and keep all of the masks. That’s how powerful China is when it comes to supply chain. The good news is that the US is realizing how dependent we are on China which may spur manufacturing to continue moving back to the US and possibly at a quicker rate. If the coronavirus continues to stagnate the Chinese economy, we will be forced to start manufacturing more in the US and Mexico. We’ve already realized this with energy and are now ramping up domestic energy production. For right now I would expect to see Chinese commodities become tougher to find and prices will rise. Slowly, but at a quicker rate than a year ago we will see the supply chain move back to North America. I would also expect Mexico to see manufacturing and supply chain growth, especially since USMCA is in effect now and labor is cheaper in Mexico. As far as the real estate market goes, I expect industrial to hit a small bump in the road, especially in the distribution market. I would expect manufacturing buildings to lease up and flex buildings to continue to lease and sell at a steady rate. I would expect the residential market to remain strong due to continued high demand and limited supply. This may even create a tougher market for buyers and new construction as a whole, because building materials could increase in cost due to the supply chain being choked by global coronavirus fears. Long term, bringing manufacturing and supply chain back to the US will create a stronger US economy and help the environment because the US has high environmental standards compared to China.

1 Comment

mark dickerson

3/12/2020 09:43:23 am

nice analogy

Reply

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed