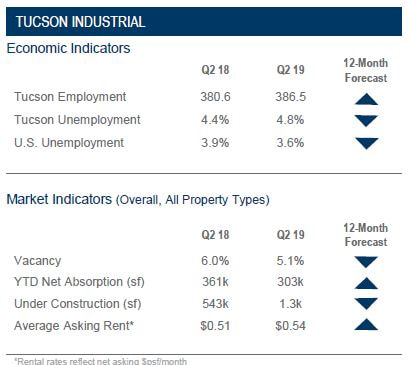

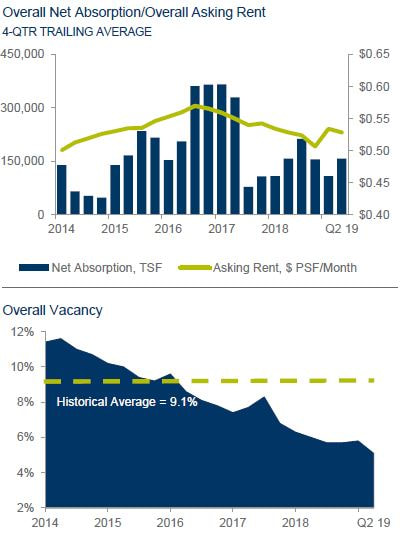

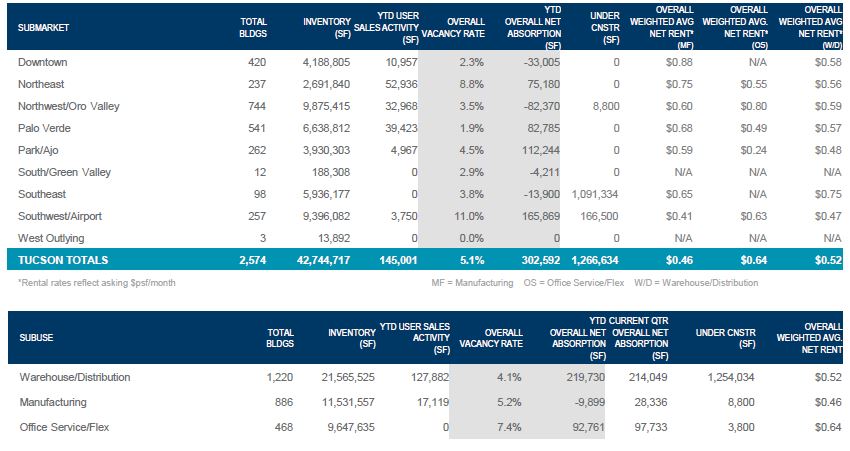

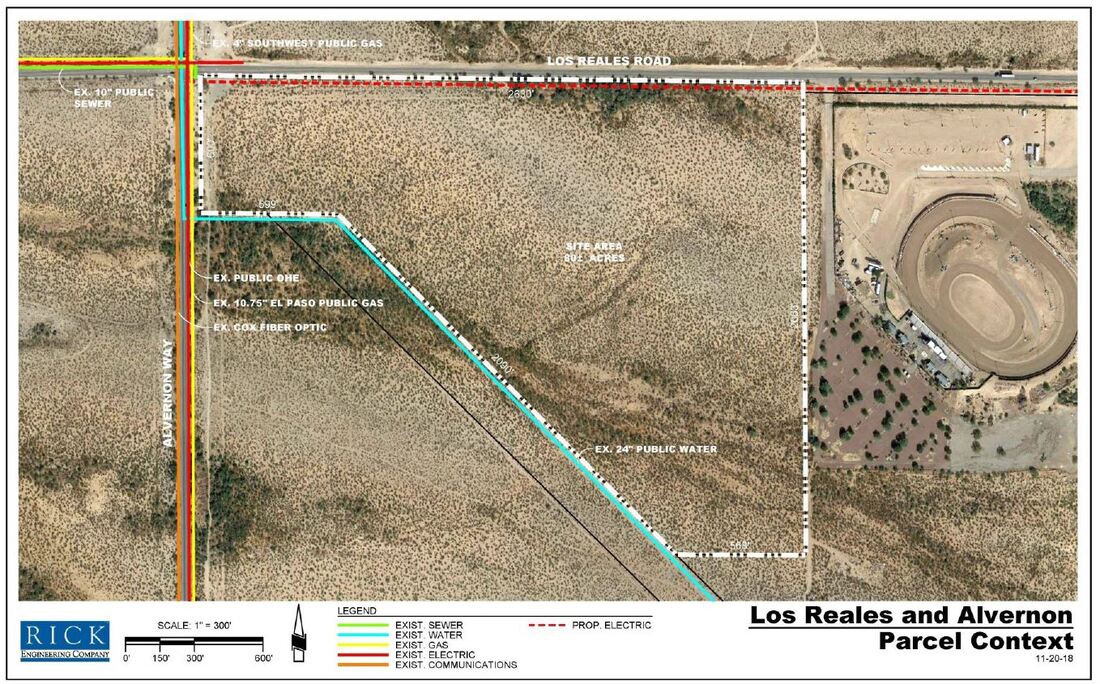

By Mid-Year, Tucson Is Nearing Heights Of Employment Not Seen Since The Cycles Of 1969 & 19987/15/2019 Economy Construction, manufacturing, education and healthcare sectors led Tucson’s job growth. Tucson’s regional economy tracked positively alongside state and national metrics at the midpoint of 2019. While slightly behind the broader state’s GDP of 3.2%, at 2.9%, Tucson’s real GDP shined relative to such other western metro areas as San Diego, Salt Lake City, and Las Vegas. Consumer confidence remained strong in both the region and the US, despite tariff concerns. Tucson added 5,900 jobs over the year. By mid-year, Tucson was nearing heights of employment not seen since the cycles of 1969 and 1998. Market Overview The Tucson industrial market remained strong at midyear, as evidenced by our primary metric: Vacancy rate. Once again, vacancy has ticked-down, this time to 5.1%. Echoing the comments last quarter, Tucson is experiencing a “plateau effect” in the industrial sector in that the dynamic run-up in absorption slowed as the market leveled off at a highly-occupied equilibrium. Accordingly, this plateau resulted in a slow-down in leasing activity, as few options remained available to lease, and in many cases, companies operated existing facilities out of necessity rather than desire. Rents appeared to be rising at a measured pace as well, a natural outcome of the condition of such low vacancy. The gap in the industrial market continued to be seen in spaces over 100,000 square feet (sf), for which activity has been traditionally anemic. Signs of life in this sector have appeared with one recent lease completion over 100k sf and several others currently in the market. On the investment side, while volumes for the first half of the year did not match early 2018, average price / sf (psf) continues to climb and at $93.41 psf in Q2 was the highest average on record. Available inventory has been a contributing factor, with only 1.6 msf on the market the lowest available for sale since pre-recession 2008. Outlook In the event that several of the current 100k sf users in the market do in fact land new leases and absent a market correction, Tucson will see vacancy dip to unprecedented low levels which might force new speculative construction. The outlook for the Tucson industrial market remains strong in the near-term. The mining, distribution and defense industries continue to lead the way, bringing into their orbit smaller vendors and suppliers, and small business is projected to remain stable with continued lateral moves. Featured Industrial Property For Sale Listed by Rob Glaser and Max Fisher, Cushman & Wakefield | PICOR 78 Acres $1.90/ SF ($6,450,000) (Pricing subject to change if parcel is split) •2.2 miles from I-10 & Tucson International Airport •Neighboring parcels include: HomeGoods Distribution, FedEx, Old Dominion, Ontrac, and Tucson Airport Authority •Prime logistics or UB parcel with proposed development plan •CI-2, Pima County, Heavy Industrial •Potential for Mexico – US safe distribution Proposed Development Plans

1 Comment

|

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed