|

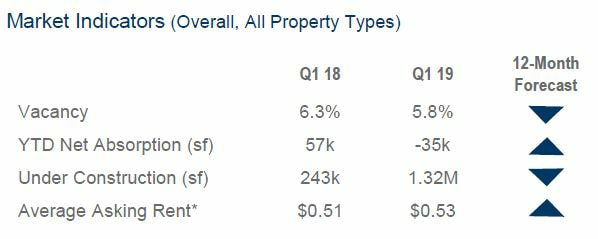

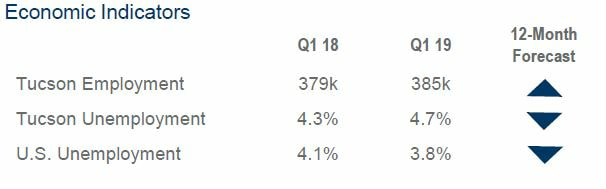

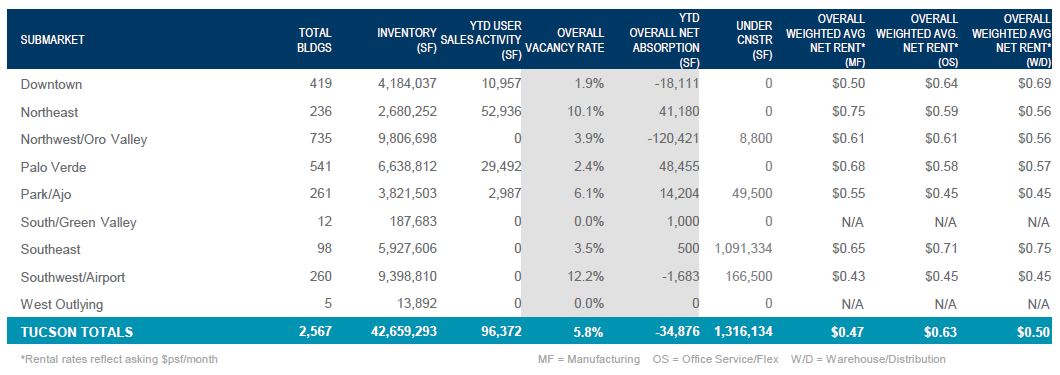

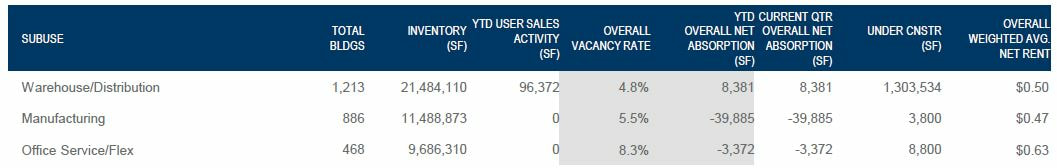

Economy The state of Arizona is riding an employment high with over 110,000 jobs added in 2018 and continued momentum into 2019, with employment growth ranking third in the nation for the first two months of the year.Tucson continued to experience full employment, ending February at a 4.5% unemployment rate and adding 5,400 jobs over the past year. Occupational areas expected to have the highest growth in the next 12 months are Architecture and Engineering at 9.0%, Computer and Mathematical at 6.4% and Construction and Extraction at 6.1%.Tucson’s average home sales price of $259,466 was up 4.2% year over year, while new home permits were up 5.2% in the same time period. Taxable retail sales statewide were up 4.9% in January over the prior year. Market Overview Ending with a slight increase in overall vacancy quarter over quarter, the Tucson industrial market’s performance was reflective of a point of overall stability after two years of unprecedented absorption. Available inventory is expected to continue to tighten in buildings with spaces under 5,000 square feet (sf), as well as within some of the higher-quality vacancies in larger blocks. As national shopping trends shift brick-and-mortar retail demand increasingly to eCommerce, local demand from retailers and logistics companies for related warehouse and distribution space has followed suit. Amazon is nearing completion of both an 850,000 sf fulfillment center near Interstate 10 and Kolb and a 50,000 sf last-mile delivery facility near the I-10 and I-19 interchange. Total industrial space under construction Q1 totaled 1.32 million square feet, inclusive of these two projects. Several national companies are in the market for supplemental warehousing facilities. Sales activity has also been off to a strong start in 2019, with first quarter volume of $30.0 million up 37.3% over the same quarter 2018. Sale prices for the quarter averaged $91.71 per square feet, consistent with pricing throughout 2018. Outlook In contrast to the frenzy of activity during the prior two years, overall market activity will continue at a more stabilized, moderate pace. This is not reflective of a slowdown in general market interest, but instead a decreasing supply of higher-profile, functional space alternatives, particular for national credit users. In spite of this market appetite for newer higher-quality inventory, the slow pace of rent growth is not yet high enough to spur significant speculative construction in the near term. One bright spot which has been anticipated and welcomed is the notable uptick in market interest from larger warehouse users (over 100,000 sf). Should a few of these translate to completed lease transactions, overall market occupancy could reach unprecedented levels and place increased pressure on new development.

0 Comments

Leave a Reply. |

AuthorMax Fisher, Industrial Properties Broker Archives

April 2024

Categories |

RSS Feed

RSS Feed